Disclosure: The author of this story owns shares in MicroStrategy (MSTR).

Since Donald Trump won the U.S. election on Nov. 5, bitcoin (BTC) has soared from $67,000 to around $100,000. This has coincided with a huge rise in bitcoin’s total trade volume which has now surpassed $100 billion.

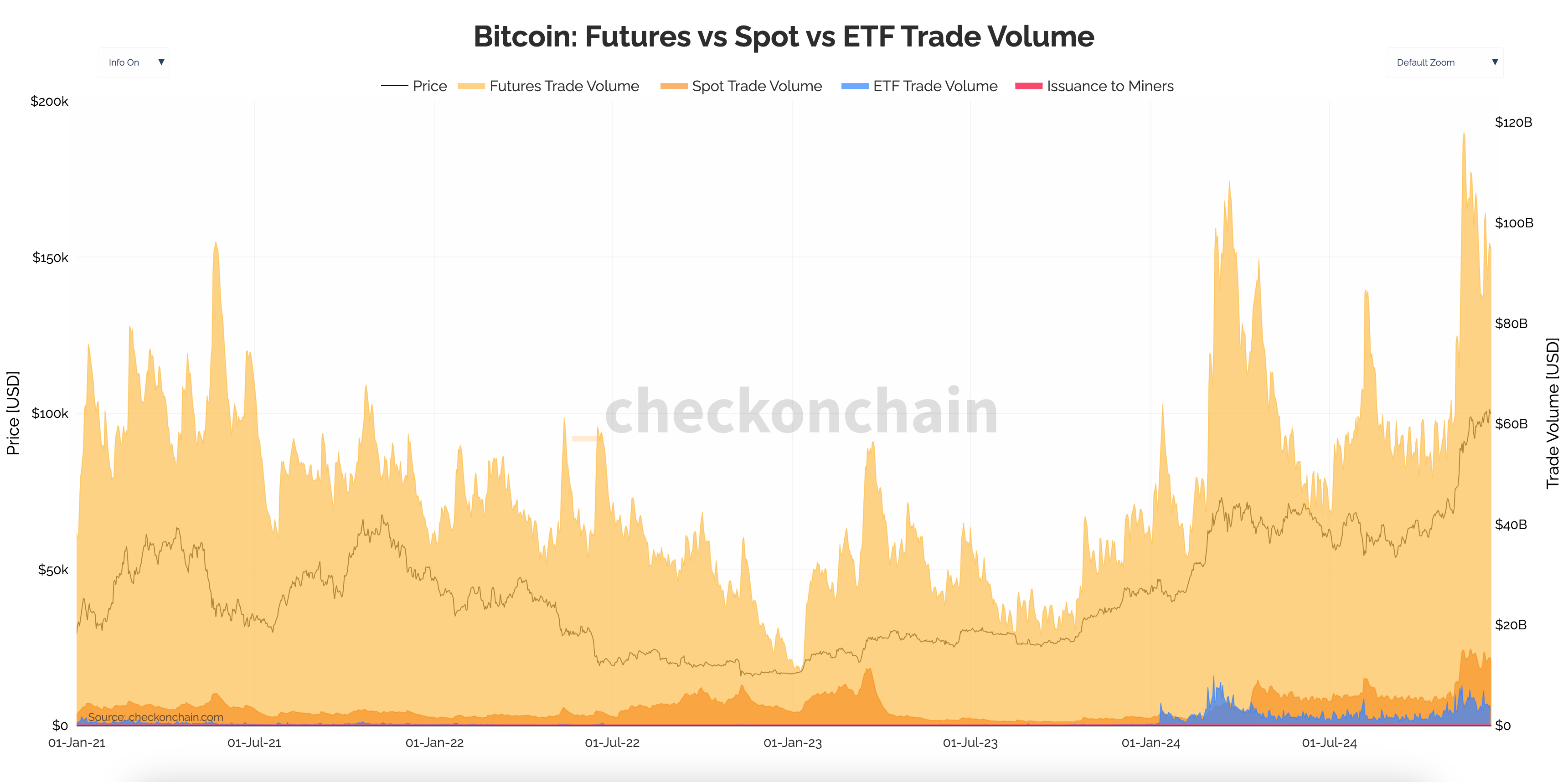

According to checkonchain data, bitcoin futures trading volume hit an all-time high of around $120 billion on Nov. 17, almost doubling since the U.S. election. However, since then futures trade volume has plateaued and steadied around $100 billion.

The same can be seen with spot trade volume which has also doubled from around $6 billion to $12 billion. While the spot listed U.S. exchange-traded funds (ETF) trade volume has also picked up reaching $4 billion a day.

Bitcoin remains in a key trading range of $100,000, going above and below the key psychological area on multiple occasions. A lot of this has to do with the enormous sell pressure coming from long-term holders (LTH) or investors who have held bitcoin for longer than 155 days.

Since September, LTHs have sold 843,113 BTC. In the same period short-term holders (STHs), those who have held bitcoin for less than 155 days, have accumulated 1,081,633 BTC. This works out to around 9,960 BTC sold by LTHs and STHs accumulating 12,432 BTC per day.

To show the difference of trading volumes between long and short-term holders, we compare them to other big players in the industry, such as the self-described bitcoin development company MicroStrategy (MSTR). MicroStrategy holds 423,650 bitcoin or just over 2% of the total supply. In addition, U.S. ETFs now hold over 1 million bitcoin.

Since September, MicroStrategy has accumulated 197,250 BTC, which works out to roughly 2,168 BTC per day. While, the U.S ETFs have accumulated approximately 205,000 BTC, which works out to 2,253 BTC per day. The U.S. ETF BTC balance has grown from 916,000 BTC to 1.12 million BTC.

In order for bitcoin to conclusively break higher of $100,000 we will need to see LTHs dial down on offloading their tokens or have bigger cohorts enter the space and pick up the buys.