Crypto exchange Coinbase has lost market share in the booming ether (ETH) staking business as mounting pressure from U.S. regulators weighs on its staking service.

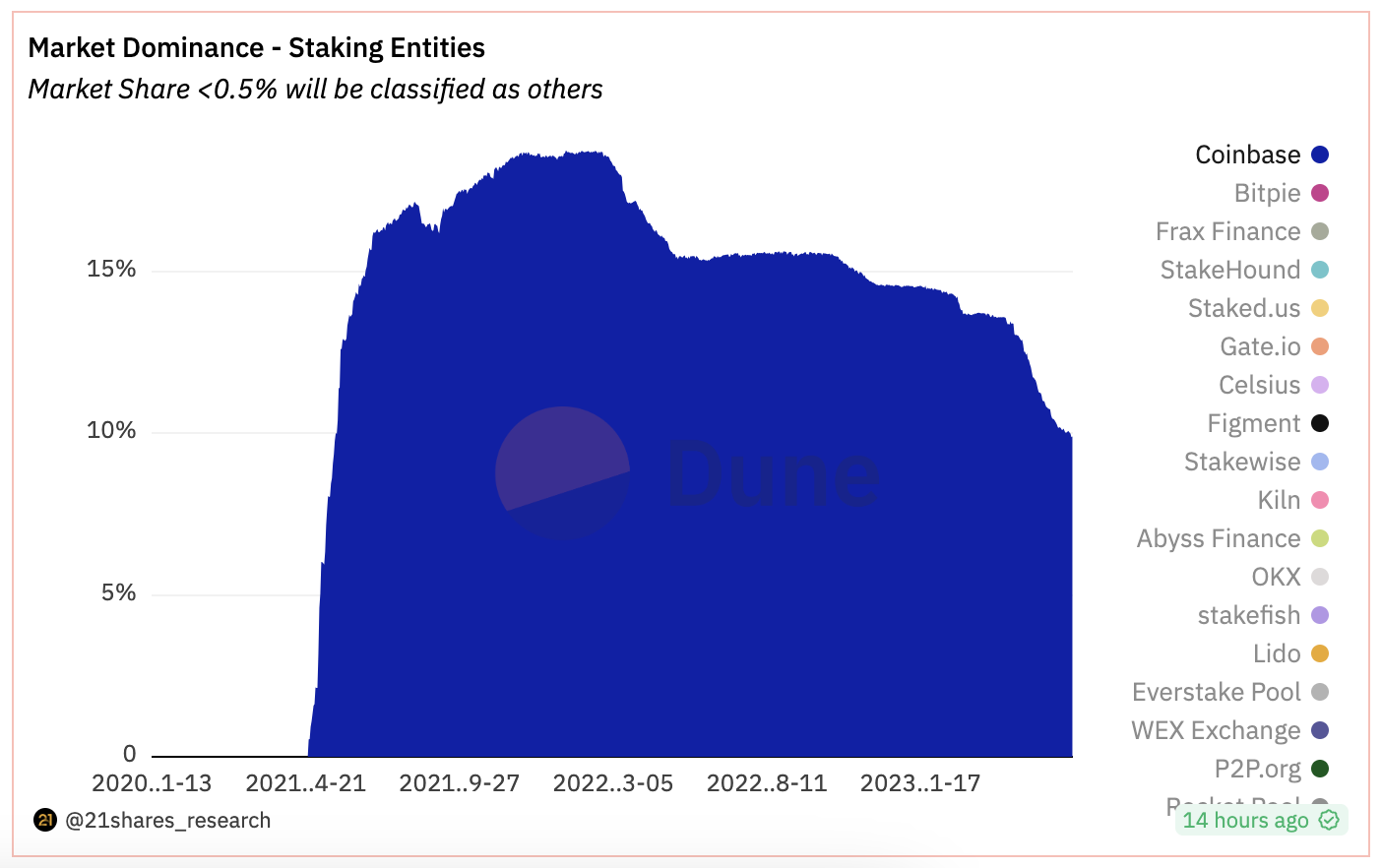

The exchange’s share in ETH staking slipped to 9.7%, the lowest level since May 2021, according to a Dune analytics chart by digital asset investment product-issuer 21Shares. This is a significant drop from the 13.6% recorded on April 12, when Ethereum’s Shanghai upgrade allowed withdrawals for the first time.

The downturn has happened as the demand for ETH staking – locking up tokens to participate in securing the blockchain while earning a passive income on holdings – was soaring. The Shanghai upgrade unleashed a wave of deposits to staking, with inflows outpacing withdrawals by some 3.5 million ETH, worth $7.3 billion at current prices.

Coinbase, however, suffered a net outflow of $517 million (272,315 ETH) during the same period, the second-largest amount after rival crypto exchange Kraken.

“A potential reason could be that investors do not want to be exposed to regulatory risk by using Coinbase’s staking services,” Tom Wan, analyst at 21Shares, told CoinDesk in a note.

Kraken was sued by the U.S. Securities and Exchange Commission (SEC) earlier this year and shuttered its staking service for U.S. customers as part of a settlement with the agency.

On June 6, the SEC also filed a lawsuit against Coinbase for violating federal securities laws, including offering unregistered securities to users with its staking service. However, the exchange said it remained committed to keeping its staking service.

Since the lawsuit, Coinbase has withdrawn some 149,300 ETH from Ethereum’s proof–of-stake network, while depositing only 52,992 tokens, blockchain data compiled by 21Shares shows. The $183 million net outflow indicates that users were unstaking tokens and fleeing the exchange.

Coinbase still held its position as the second largest staking service provider, but fast-growing rivals such as Figment, RocketPool and Kiln have been closing the gap, a Dune chart shows.

The exchange takes a 25% commission on user rewards earned by staking, so a decrease in the amount of staked tokens means less revenue.