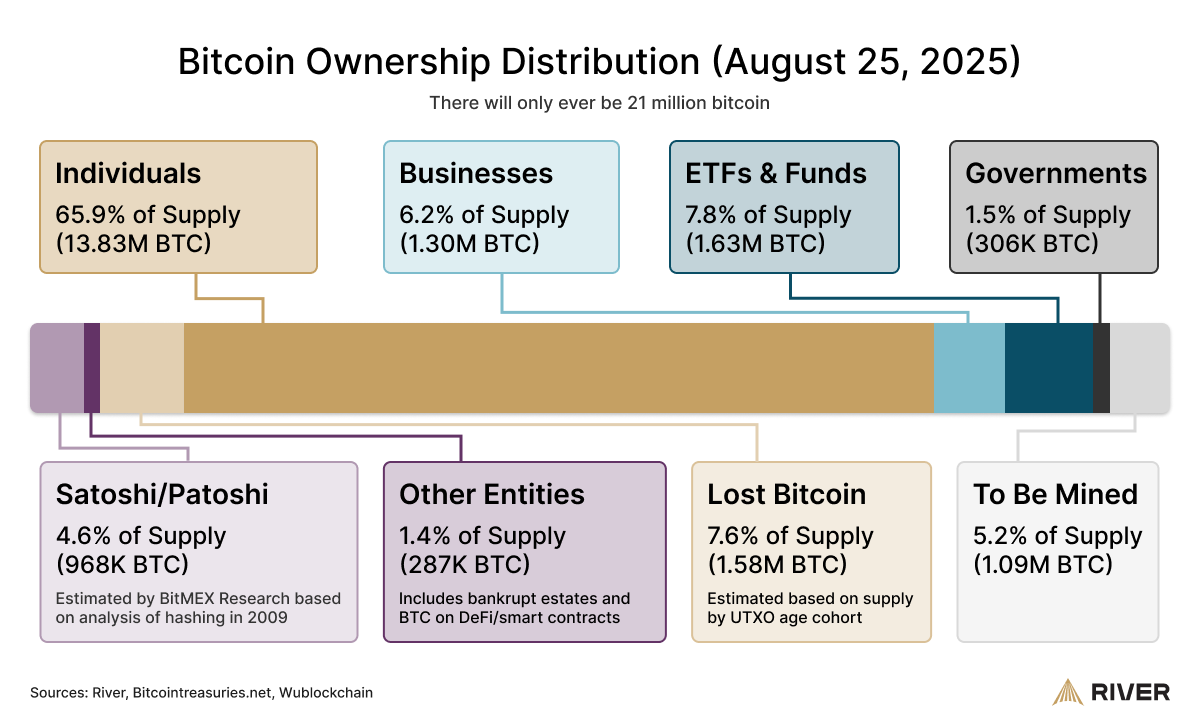

River says individuals still own the majority of bitcoin.

The U.S.-based bitcoin financial services firm revealed ownership distribution research dated Aug. 25 in a recent post on X. The study groups bitcoin supply into a few categories and shows the market share of each, using public filings, custodial address tagging and earlier blockchain research.

River estimates individuals control about 65.9% of circulating BTC, or 13.83 million coins. This bucket includes self-custodied wallets and exchange accounts that River classifies as individual.

On the institutional side, River divides holdings into businesses, ETFs and funds.

- Businesses — a global category covering corporate treasuries and conventional firms that report bitcoin holdings — account for about 6.2% of supply, or 1.30 million BTC.

- ETFs and funds — spot ETFs and investment vehicles that custody coins for clients — control about 7.8%, or 1.63 million BTC.

Governments are shown at about 1.5%, or 306,000 BTC, based on sovereign addresses tracked from public sources.

Two special categories round out the distribution:

- Lost bitcoin makes up about 7.6%, or 1.58 million BTC. River says this is inferred from age heuristics, which show coins that have not moved for many years and are likely unrecoverable.

- Satoshi/Patoshi holdings are pegged at about 4.6%, or 968,000 BTC, based on earlier research into early-era mining patterns.

Finally, about 5.2% of the supply, or 1.09 million BTC, has yet to be mined before the hard cap of 21 million is reached.

In plain terms, River’s research is an attempt to map who holds bitcoin today, not to forecast future prices. The estimates are not definitive, since custodians aggregate many clients, some wallets are misclassified, and ownership can be opaque.

River’s conclusion is that individuals still dominate holdings, but the institutional share is expanding, helped by the growth of ETFs and companies that now treat bitcoin as a balance-sheet asset.