The cryptocurrency market is showing initial signs of recovery from its worst month in three years after the price of bitcoin (BTC) plunged to $78,000 in a week that saw the space’s total market capitalization drop by over $400 billion.

The dip in prices saw the Crypto Fear & Greed Index plunge to 10, a level that hadn’t been seen since the 2022 bear market. However, it has since recovered to 20 while still being in the “extreme fear” range.

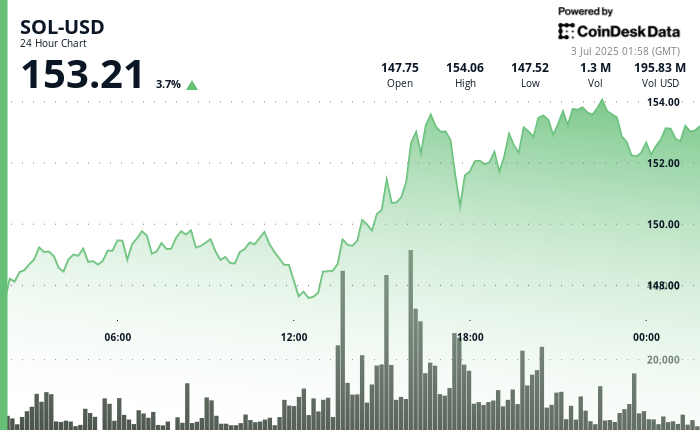

Bitcoin’s price has now risen more than 3% in the last 24-hour period to now trade above $84,400, while the broader CoinDesk 20 Index (CD20) rose 1.5% in the same period to 2,700. Its performance is being affected by SOL dipping nearly 3% in the period, while other components are up for the day.

The cryptocurrency market seemed to have caught a bid after the White House announced that U.S. President Donald Trump will host a crypto summit on March 7. Summit attendees are set to include “prominent founders, CEOs, and investors from the crypto industry, as well as members of the President’s Working Group on Digital Assets, according to a press release.

The event is the latest sign of the Trump administration’s pro-crypto policies. It comes after the U.S. Securities and Exchange Commission (SEC) dropped lawsuits against Coinbase and MetaMask developer Consensys, as well as investigations Into Robinhood, Gemini, Uniswap Labs, and OpenSea.

In addition, the world’s largest asset manager, BlackRock, has added a 1% to 2% allocation of its iShares Bitcoin Trust (IBIT) to one of its model portfolios. These models propose portfolio and rebalancing strategies that are subsequently executed by advisors and platforms. This is the first time BlackRock has decided to add IBIT to any of its models, opening up the potential for a new wave of demand for bitcoin ETFs.

As of December 31, 2024, BlackRock’s model portfolios manage approximately $150 billion in assets.

Read more: Bitcoin Dip-Buyers Step in Friday, but What Might Weekend Action Bring?