Crypto exchange giant Binance’s BUSD stablecoin has extended its recent declines, amid mismanagement issues involving the exchange’s pegged tokens that surfaced earlier this month, and other debacles.

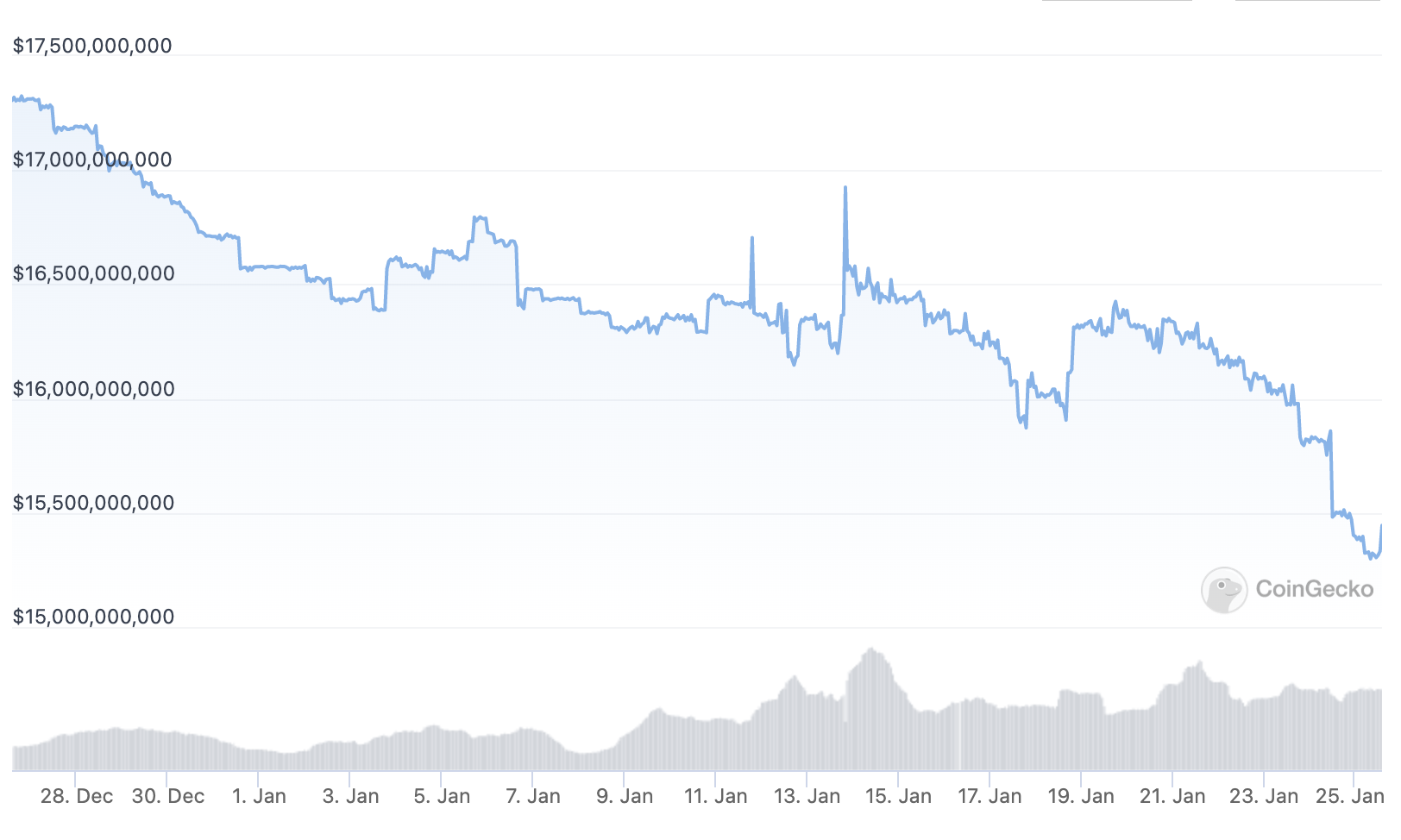

BUSD’s circulating supply fell to $15.4 billion on Wednesday, paring down $1 billion over the past week and $2 billion in a month, according to cryptocurrency price tracker CoinGecko. The latest drop extended BUSD’s decline from $22 billion in early December when anxious users scrambled to withdraw funds from Binance after it botched a report about its digital asset reserves.

BUSD lost $2 billion of its market value in 30 days, the most among its closest competitors. (CoinGecko)

BUSD is a dollar-pegged stablecoin issued by the New York-based fintech firm Paxos Trust under the Binance brand, backed by cash and U.S. Treasury bill reserves. Traders use stablecoins as an intermediary to convert traditional fiat money to digital assets and facilitate trading cryptocurrencies.

The latest decline comes amid recent reports about errors involving the exchange’s wrapped token derivatives known as Binance-peg tokens.

Earlier this month, blockchain research firm ChainArgos found that Binance-peg BUSD was not always fully backed by reserves during 2020 and 2021. Binance acknowledged the breach and said it has fixed them. This week, Bloomberg reported the exchange mixed customer funds with the collateral of Binance-peg tokens.

In a blow for retail traders, Binance’s banking partner Signature Bank will halt transfers smaller than $100,000 using the SWIFT interbank messaging system, starting Feb. 1.

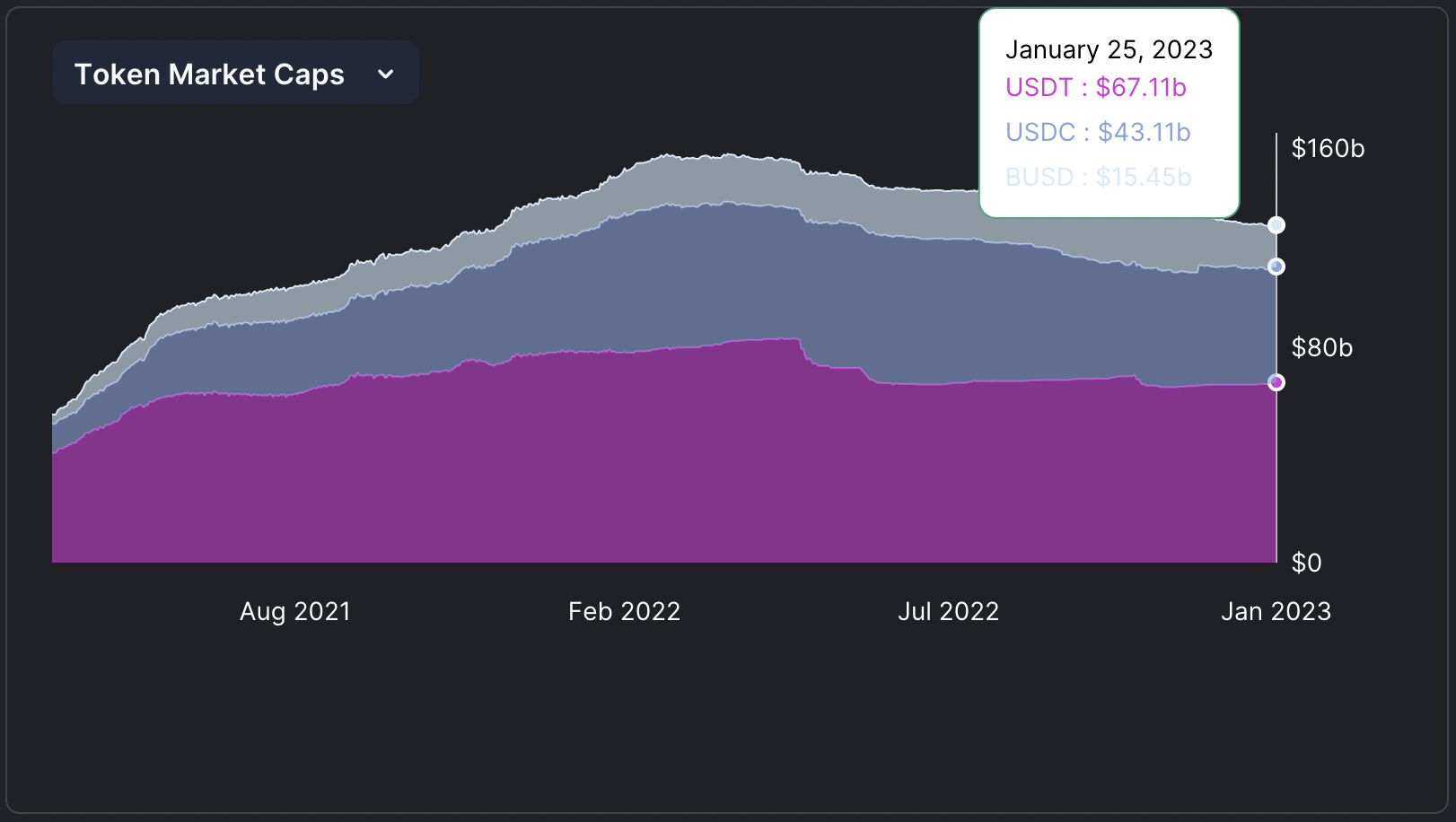

The recent issues resulted in BUSD falling further behind stablecoin rivals in what has become a fierce competition. BUSD lost 11.3% of its market capitalization in a month, while USDT gained 1.3% and USDC dropped just 1.9%, according to data by DefiLlama, which tracks digital assets’ performances. Still, BUSD is the only one of the top three stablecoins that grew its market value through last year.

Market capitalization of the top three stablecoins: USDT, USDC and BUSD. (DefiLlama)

The overall market capitalization of stablecoins fell for a 10th consecutive month in January, to $137 billion, according to a report by research group CryptoCompare. Stablecoin dominance within the broad cryptocurrency market dropped to 12.4% from its all-time high of 16.5% in December, suggesting traders have been rotating from stablecoins into riskier assets, CryptoCompare said.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.