Centralized crypto exchange giants Binance and Coinbase have suffered large outflows of staked ether (ETH) since Ethereum’s Shanghai upgrade as investors flock to decentralized rivals, blockchain data shows.

Coinbase’s staking platform has endured a $367 million net outflow of staked ETH since April 12, as withdrawal requests – including reward withdrawals and full exits – outpaced new deposits, according to a Dune Analytics data dashboard. The world’s largest crypto exchange Binance’s staking service has seen a net outflow of $340 million.

Decentralized liquid staking protocols, on the other hand, have enjoyed a sharp rise in deposits. Frax Finance and Rocket Pool, the two of the largest gainers, have recorded net inflows of $56 million and $68 million, respectively.

The development has followed Ethereum’s highly anticipated Shanghai upgrade on April 12, which allowed investors to withdraw some $35 billion of tokens previously locked up in staking contracts. Analysts predicted that the event would be a major milestone for the $225 billion network, likely boosting staking participation, attracting institutional investors and reshuffling the competition between staking services.

The upgrade has been “a major catalyst” for decentralized liquid staking solutions, Ahmed Ismail, founder and chief executive of liquidity aggregator platform FLUID Finance, said.

Liquid staking protocols issue a derivative token that represents the amount of locked tokens and lets investors access decentralized finance (DeFi) services such as lending and borrowing.

Boosted by new deposits, the amount of ETH staked on Frax and Rocket Pool has grown 32.5% and 31% in the past 30 days, respectively, according to DefiLlama data.

Lido Finance, the largest decentralized liquid staking protocol with some $11 billion of deposits, has also booked some $28 million (15,208 ETH) more deposits than withdrawals since April 12.

Regulatory concerns, higher yields

Regulatory risks and aversion to centralized crypto platforms after last year’s bankruptcies are likely among the reasons that drive investors to decentralized staking protocols, Tom Wan, an analyst at digital asset investment firm 21Shares, said in a note.

This February, crypto exchange Kraken agreed to shutter its staking service after the U.S. Securities and Exchange Commission (SEC) charged the exchange for offering unregistered securities. Liquid staking tokens surged following the settlement as the SEC appeared to come after staking service providers, benefitting decentralized liquid staking.

Regulatory pressure on centralized entities may continue, John “Omakase” Lo, head of digital assets at investment firm Recharge Capital, said.

“The uncertainty isn’t good for retaining deposits,” he added.

Investors could also be swayed by higher staking rewards that decentralized protocols can provide. Currently, Coinbase and Binance offer around 4% annualized reward for staking ETH, whereas decentralized protocols Lido Finance and Frax Finance provide 5-7% rates.

“Centralized liquid staking usually has a lower yield profile. Compliance and staffing all add up,” Omakase said.

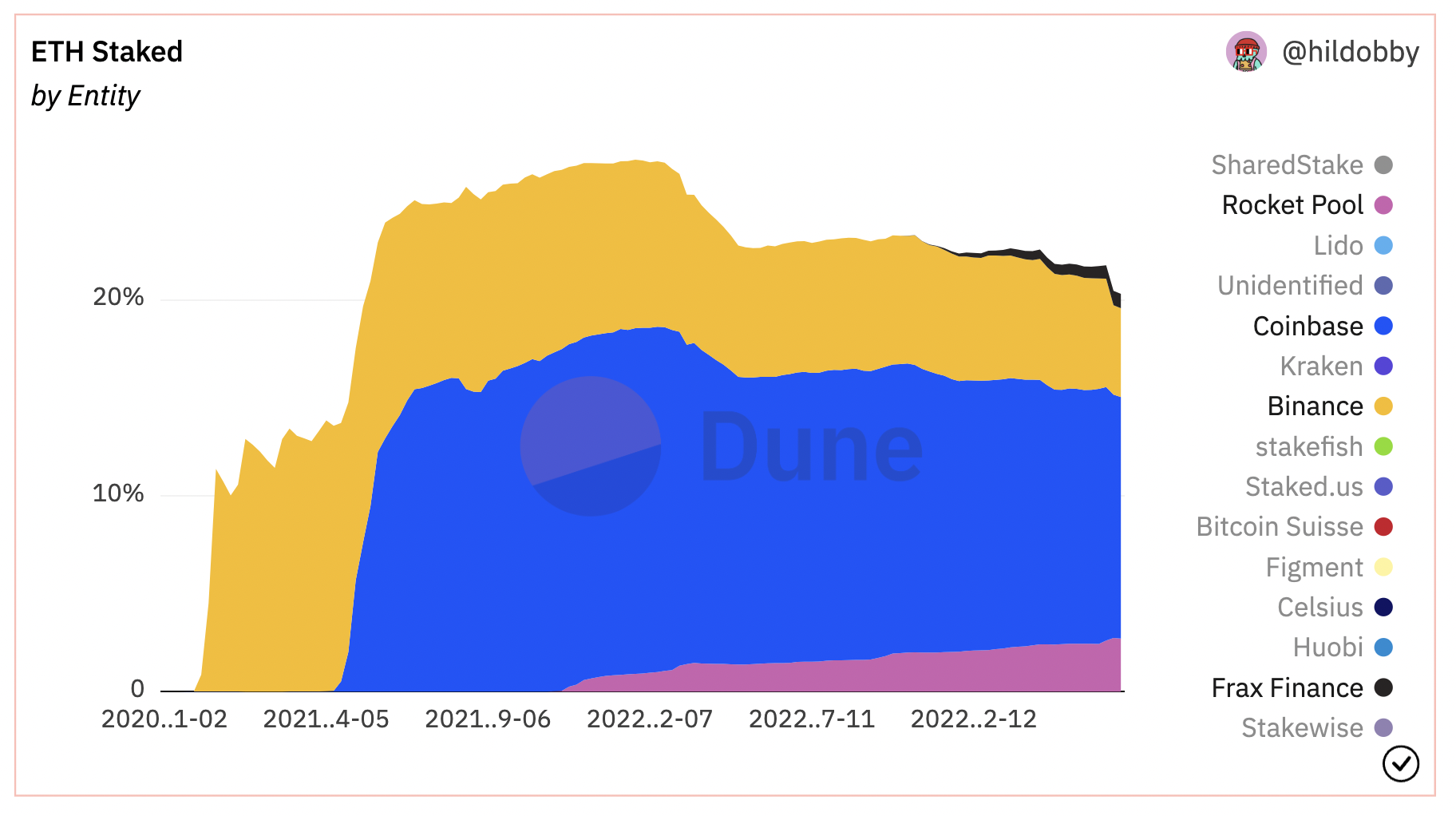

Market share of ETH staking protocols (Hildobby.eth/Dune Analytics)

Despite recent outflows, Binance and Coinbase remain among the largest ETH staking providers. However, Binance’s market share fell to 4.5% from 5.7% a month ago, while Coinbase’s share dropped to 12.3% from 13%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)