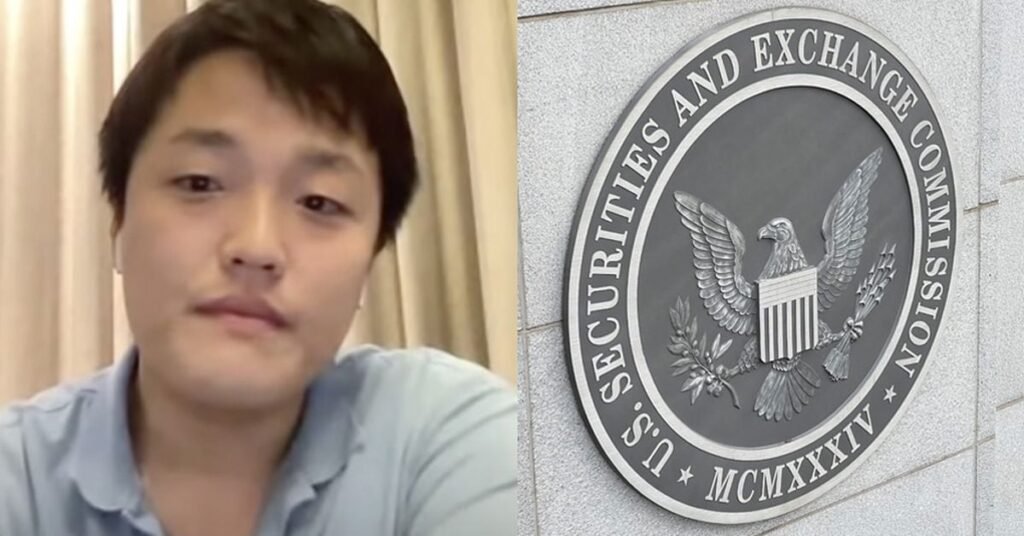

-

The

SEC

asked

a

New

York

judge

to

impose

$5.3

billion

in

fines

against

Terraform

Labs

and

Do

Kwon

to

resolve

the

civil

fraud

case

against

them. -

The

regulator

says

the

fines

are

a

“conservative”

but

“reasonable

approximation”

of

Terraform

and

Kwon’s

“ill-gotten

gains”

from

the

fraud.

The

U.S.

Securities

and

Exchange

Commission

(SEC)

has

asked

a

New

York

court

to

impose

$5.3

billion

in

fines

on

Terraform

Labs

and

co-founder

Do

Kwon

for

their

role

in

the

$40

billion

implosion

of

the

Terra

ecosystem

in

2022.

Terraform

Labs

and

Kwon

were

found

liable

on

civil

fraud

charges

earlier

this

month,

when

a

Manhattan

jury

concluded

that

they

had

misled

investors

about

the

stability

of

their

so-called

“algorithmic”

native

stablecoin,

Terra

USD

(UST),

and

the

use

cases

for

the

Terra

blockchain.

In

the

SEC’s

motion

for

final

judgment,

filed

two

weeks

after

the

conclusion

of

the

trial,

the

regulator

is

requesting

that

Terraform

Labs

and

Kwon

pay

$4.74

billion

in

disgorgement

and

prejudgment

interest,

as

well

as

a

collective

$520

million

in

civil

penalties:

$420

million

from

Terraform

Labs

and

$100

million

from

Kwon’s

pocket.

In

an

accompanying

memorandum

of

law,

the

SEC

attempted

to

justify

the

total

amount

to

the

court

by

saying

that

Kwon

and

Terraform

Labs

made

“over

$4

billion

in

ill-gotten

gains

(and

likely

much

more)

from

their

illegal

conduct.”

Sales

of

LUNA

and

MIR

to

institutional

investors

totaled

$65.2

million

and

$4.3

million,

respectively,

sales

of

LUNA

and

UST

through

the

Luna

Foundation

Guard

(LFG)

totaled

$1.8

billion,

and

investors

bought

$2.3

billion

in

UST

on

various

crypto

asset

trading

platforms

between

June

2021

and

May

2022,

according

to

court

documents.

The

SEC

added

that

the

fine

amount

represented

a

“conservative”

but

“reasonable

approximation”

of

Terraform

and

Kwon’s

“ill-gotten

gains.”

No

remorse

In

addition

to

steep

monetary

penalties,

the

SEC

is

also

seeking

injunctions

preventing

Kwon

and

Terraform

Labs

from

committing

further

securities

violations,

buying

or

selling

“any

crypto

asset

security,”

as

well

as

an

officer-and-director

ban

on

Kwon,

which

would

bar

him

from

ever

serving

as

an

officer

or

director

at

an

SEC-reporting

public

company.

The

SEC

said

such

measures

were

necessary

to

deter

future

violations,

as

“Defendants

have

not

shown

remorse

for

their

conduct,

nor

can

there

be

any

doubt

that

they

are

in

position

where

additional

violations

are

not

only

possible

but

likely

are

already

occurring.”

The

SEC

appeared

to

take

particular

issue

with

current

Terraform

Labs’

CEO

Chris

Amani’s

testimony

during

the

nine-day

trial,

during

which

he

said

that

the

company

is

“still

working

to

build”

products

and

continuing

to

sell

tokens.

The

SEC

called

Amani’s

testimony

a

“frank

acknowledgement

of

likely

recidivism”

and

added:

“Terraform’s

new

CEO

took

the

stand

in

a

stunning

display

of

chutzpah

and

attempted

to

garner

sympathy

by

noting

that

Terraform

had

distributed

a

new

version

of

their

token

–

LUNA

2.0

–

to

their

victims,

all

the

while

continuing

to

spend

the

millions

they

had

reaped

from

investors

and

engaging

in

additional

unregistered

distributions

of

these

securities.”

Terraform

weighs

in

In

a

motion

filed

the

same

day

as

the

SEC’s,

Terraform

said

that

the

court

should

not

grant

the

SEC

any

injunctive

relief

or

disgorgement

against

it,

only

an

“appropriate

civil

penalty”

per

violation

that

the

SEC

can

prove

occurred

in

the

U.S.

During

the

trial,

Amani

testified

that

the

company,

which

is

currently

in

bankruptcy,

had

approximately

$150

million

in

assets

remaining.

A

representative

for

Terraform

Labs

did

not

respond

to

CoinDesk’s

request

for

comment.

Do

Kwon

Kwon’s

lawyers

also

filed

a

memorandum

of

law

claiming

that

injunctive

relief

against

him

is

not

warranted,

due

to

the

fact

that

he

is

not

currently

employed

and

has

pending

criminal

charges

against

him.

They

also

added

that

Kwon

has

“no

illegal

profits

…

to

disgorge.”

Kwon

remains

in

Montenegro,

where

he

was

arrested

and

jailed

last

year

for

attempting

to

use

forged

Costa

Rican

travel

documents

en

route

to

Dubai.

The

Montenegrin

government

is

currently

weighing

competing

extradition

requests

from

both

the

U.S.

and

South

Korea,

Kwon’s

native

country,

which

both

hope

to

try

him

on

criminal

charges

tied

to

the

Terra

collapse.