Stablecoin adoption is gaining momentum among corporates and financial institutions driven by regulatory clarity and cost-savings in global money transfers, according to a survey by EY-Parthenon.

Conducted with 350 executives in June after the Senate passed the GENIUS Act, the survey found that 13% of firms already use stablecoins, mainly for cross-border payments. Among those who didn’t use stablecoins, 54% expected to adopt them within the next six to 12 months.

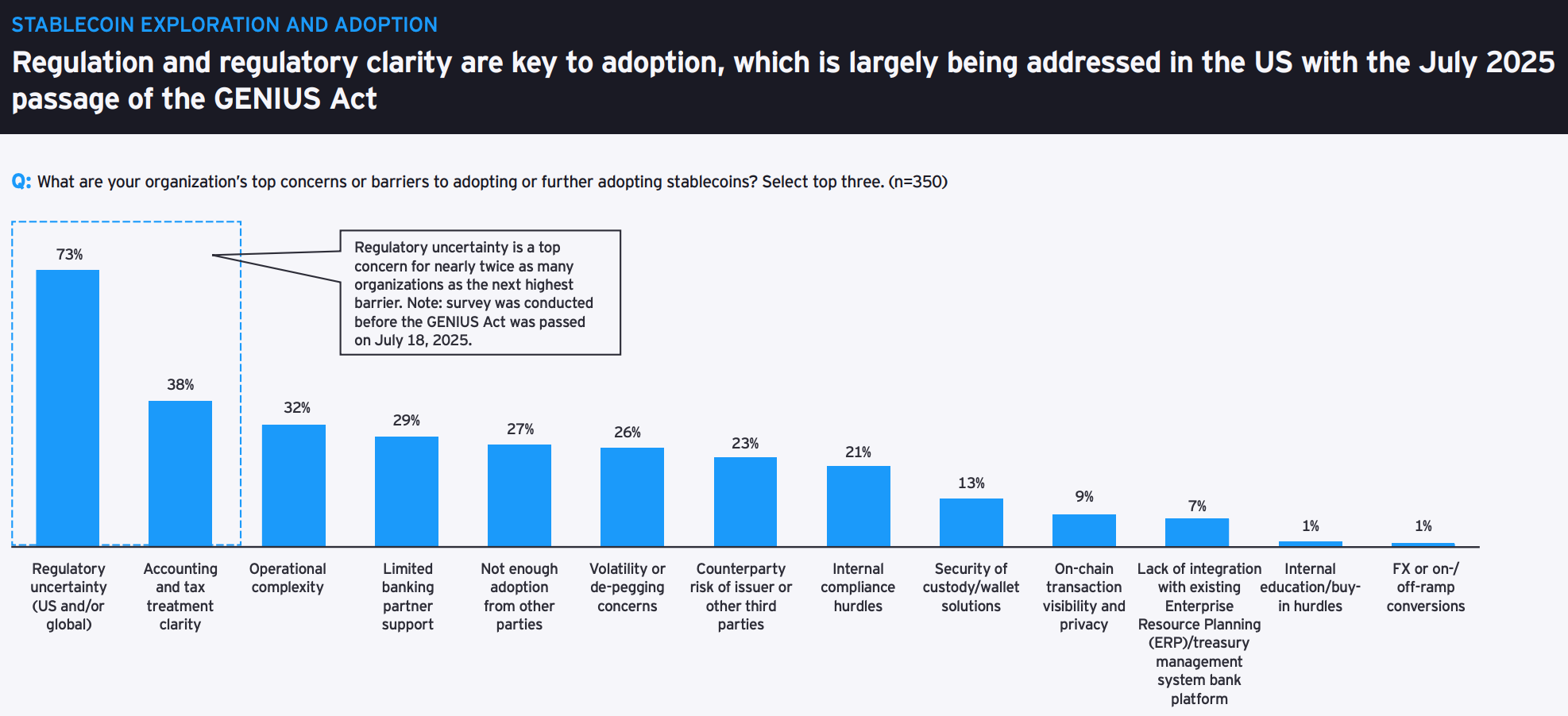

Regulatory clarity provided by the GENIUS Act was widely viewed as a turning point. The legislation, which was signed into law in July, provided long-awaited rules for U.S. dollar-denominated stablecoins, including reserve requirements and issuer approval processes.

Executives said in the survey the law reduces uncertainty around liquidity, tax treatment and custodial services.

Cost savings are also a key driver for adoption, with 41% of current users reporting at least a 10% reduction in expenses from using stablecoins in international transactions.

Respondents also saw stablecoins as a long-term fixture in global finance. By 2030, they estimate stablecoins could facilitate between 5% and 10% of all cross-border payments, representing $2.1 trillion to $4.2 trillion in value.

Still, infrastructure hurdles remain. Only 8% of businesses accepted payments in stablecoins, and many firms planned to lean on banking and fintech partners for integration.

Read more: U.S. Stablecoin Battle Could Be Zero-Sum Game: JPMorgan