Multiple institutional crypto capital firms maxed out their credit pools on Clearpool, an uncollateralized lending protocol, as fear on the market mounts that crypto trading firm Alameda Research’s liquidity troubles might spread to crypto lenders.

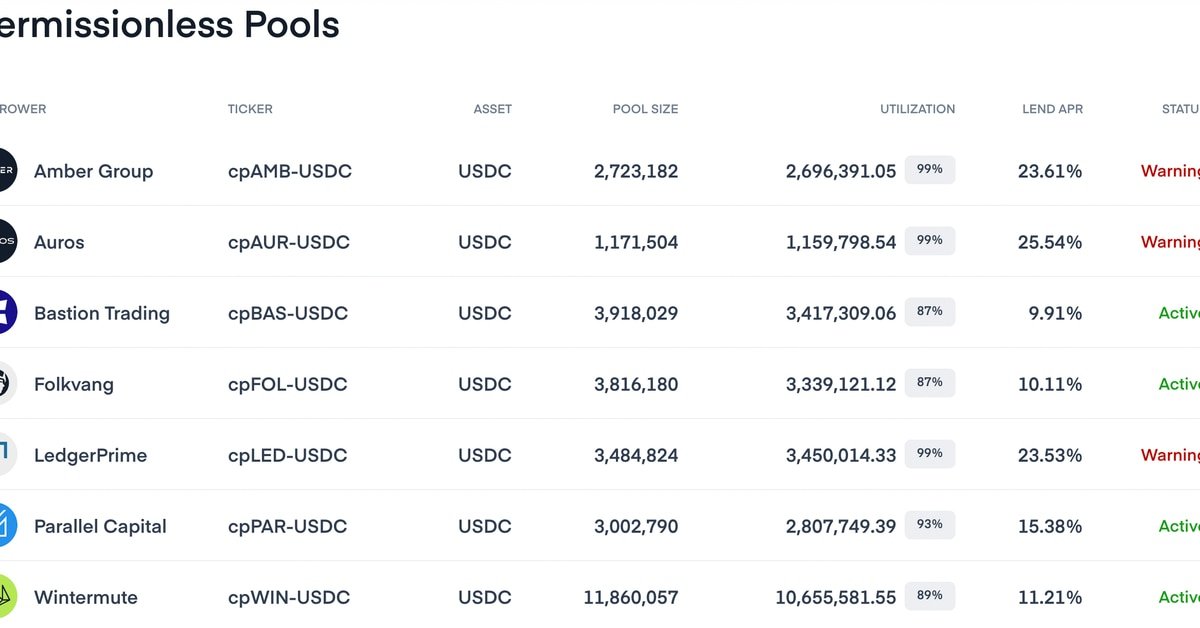

Amber Group, Auros, and LedgerPrime received a “warning” label on their respective Polygon Permissionless Pools on Clearpool because they reached 99% of the maximum amount of credit available for them on the protocol. Folkvang and Nibbio also received “warning” status on their Ethereum Permissionless Pools.

These loans represent a total of $14.8 million debt, according to Clearpool’s loan dashboard.

The five crypto firms involved have not immediately returned Coindesk’s request for comment.

Fears have mounted that Alameda Research’s deepening financial woes might potentially cause a liquidity crunch on the broader digital asset market similar to the Terra blockchain’s downfall or crypto hedge fund Three Arrows Capital’s blow-up earlier this year. Alameda is the sister company of ailing crypto exchange FTX, which rival exchange giant Binance agreed to bail out earlier Tuesday. Its balance sheet is loaded with FTT tokens that crashed 80% in a day.

Clearpool is a prominent uncollateralized lending protocol, where crypto trading firms often open credit lines and take out loans for their trading operations. Borrowers are not required to pledge assets in exchange, and the loans are secured by their reputation and alleged good financial standing.

In these types of crypto lending pools, interest rates are set dynamically depending on how much capital one takes out from the pool. As a borrower gets closer to the maximum limit of its credit line, the protocol penalizes by increasing the loan’s interest rate from the usual 8-10% to 20-25% annual percentage rate (APR).

Taking out the maximum amount of debt from these DeFi protocols is the real-life equivalent of maxing out a credit card, and might be a sign of broader financial distress on the market.

“Crypto lenders feel the credit crunch from the Alameda insolvency,” Walter Teng, vice president of digital assets at research firm Fundstrat, told CoinDesk.

Alameda’s DeFi debt

Alameda Research has been a diligent user of decentralized lending protocols, originating hundreds of millions in uncollateralized loans so far. Its current outstanding debt on DeFi protocols, however, is rather small compared to earlier this year, meaning fewer investor funds are in danger if Alameda defaults on the loans.

The trading firm took out two loans, a total of $5.5 million, from Apollo Capital and Compound Capital Management using Clearpool’s Permissioned Pool, according to Clearpool’s data dashboard.

It also borrowed $7.3 million from a TrueFi lending pool, which is due to mature Dec. 20, per TrueFi’s loan dashboard. The next interest payment is due on Nov. 20.

Lending pools on Maple Finance do not presently have active loans to Alameda, although Alameda had a lending pool that originated $288 million in loans until the spring of 2022.

This year, a series of crypto insolvencies have raised questions whether uncollateralized lending is viable in the young, volatile digital asset market. When an uncollateralized loan defaults, there aren’t any assets that creditors can reclaim immediately. The creditors only receive partial compensation from the protocols so they must resort to debt restructuring or go to court to recover their money.

“Unironically, the second instance of mass deleveraging across crypto highlights the need for transparency that DeFi offers,” Teng said.