Aptos Labs and Jump Crypto are among the prominent crypto companies that committed to contributing $50 million to a Binance-led $1 billion Industry Recovery Initiative (IRI), according to a press release.

Jump Crypto, a trading firm, and Aptos Labs, the entity behind the newly launched Aptos blockchain, are joined by venture capital firms Polygon Ventures and Animoca Brands as well GSR, Kronos and Brooker Group in contributing to the fund.

The fund will be used to buy distressed crypto assets following a downturn that has ravaged the industry for the past 12 months. A running theme of bad debt and a lack of liquidity has resulted in numerous crypto companies restricting customer withdrawals this year. Firms including crypto exchange FTX, Celsius Network, Voyager Digital, Three Arrows Capital and Compute North have filed for bankruptcy.

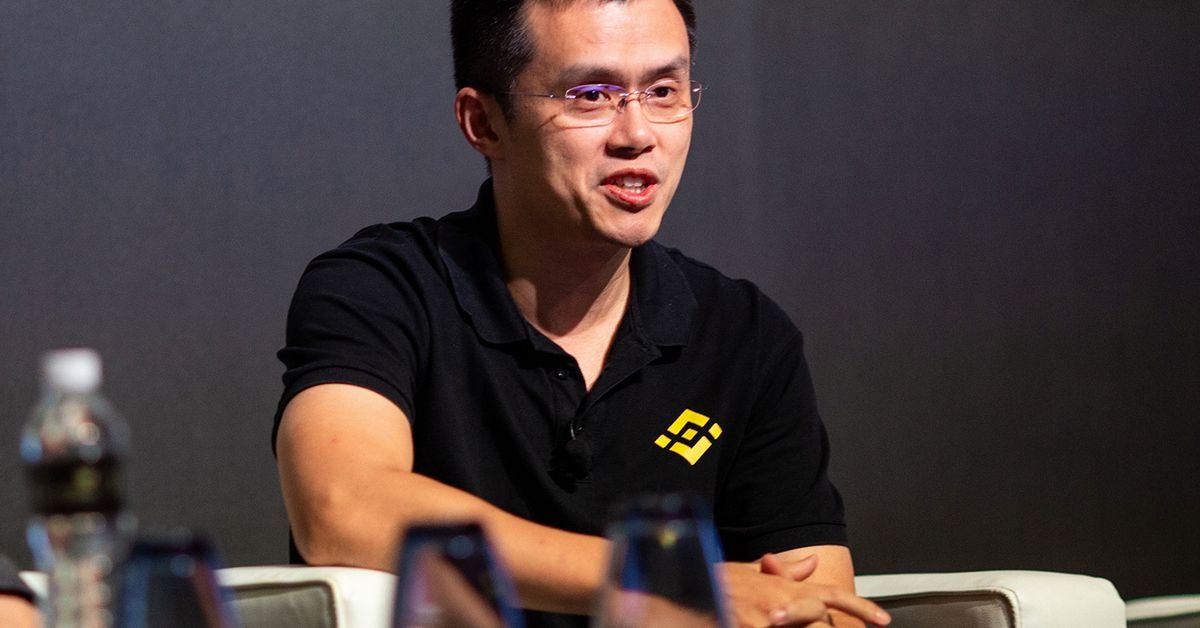

“If that’s not enough [$1 billlion] we can allocate more,” Binance CEO Changpeng Zhao said in an interview with Bloomberg today. According to the press release, Binance plans to increase the fund to $2 billion in the future.

Zhao also said the exchange’s U.S. arm will be bidding on Voyager Digital after the lender’s deal to be bought by FTX fell through.

UPDATE (Nov. 24, 2022, 16:39 UTC): Adds company descriptions, industry background, quote from Binance CEO Zhao.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.