The

FTX

estate

was

granted

approval

to

sell

its

trust

assets,

including

shares

of

Grayscale

and

Bitwise

investment

funds

worth

roughly

$873

million,

according

to

a

Delaware

bankruptcy

court

document

filed

on

Friday

and

CoinDesk

analysis.

“The

debtors

are

authorized,

but

not

directed,

to

execute

sales

of

the

trust

assets,

in

their

reasonable

business

judgment,

in

accordance

with

the

following

sale

procedures,”

the

filing

said.

The

court

also

expanded

crypto

investment

firm

Galaxy’s

mandate

to

assist

FTX

in

the

sales

of

its

trust

assets,

according

to

a

Tuesday

court

filing.

FTX

tapped

Galaxy

earlier

this

year

to

manage

the

estate’s

vast

digital

asset

holdings.

FTX’s

trust

assets

include

shares

in

various

Grayscale

funds,

including

in

Grayscale

Bitcoin

Trust

(GBTC)

and

a

Bitwise

crypto

index

fund,

which

was

worth

a

total

of

$744

million

as

of

October

25,

according

to

a

court

document

filed

on

Nov.

3.

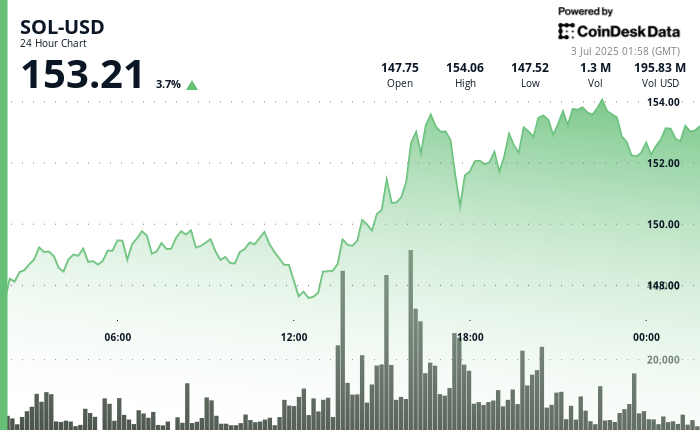

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/44Y5NW5QYJHEBPM4CYIILDOVEE.png)

FTX

trust

assets

(Kroll)

However,

FTX’s

trust

holdings

now

could

be

worth

even

more,

about

$873

million,

as

GBTC’s

discount

to

its

net

asset

value

has

narrowed

with

bitcoin

rally,

according

to

CoinDesk’s

calculation

based

on

the

reported

shareholdings

in

the

court

filing

and

Wednesday

market

closing

prices

per

TradingView

data.

The

roughly

17%

appreciation

since

Oct.

25

can

be

explained

by

the

rally

in

cryptocurrency

prices

over

the

past

month.

The

crypto

exchange,

once

helmed

by

Sam

Bankman-Fried,

was

one

of

the

world’s

largest

trading

platforms

before

it

went

bankrupt

in

November

last

year

following

a

CoinDesk

report

revealing

the

shaky

balance

sheet

of

FTX

sister

trading

firm

Alameda

Research.

UPDATE

(Nov.

29,

22:53

UTC):

Adds

detail

about

the

current

estimated

market

value

of

trust

assets

using

Wednesday

market

closing

prices.

UPDATE

(Nov.

29,

23:26

UTC):

Adds

detail

about

Galaxy

Digital

assisting

in

selling

trust

assets.