Investors are counting down to the Federal Reserve’s Sept. 17 monetary policy decision; markets expect a quarter-point rate cut that could trigger short-term volatility but potentially fuel longer-term gains across risk assets.

The economic backdrop highlights the Fed’s delicate balancing act.

According to the latest CPI report released by the U.S. Bureau of Labor Statistics on Thursday, consumer prices rose 0.4% in August, lifting the annual CPI rate to 2.9% from 2.7% in July, as shelter, food, and gasoline pushed costs higher. Core CPI also climbed 0.3%, extending its steady pace of recent months.

Producer prices told a similar story: per the latest PPI report released on Wednesday, the headline PPI index slipped 0.1% in August but remained 2.6% higher than a year earlier, while core PPI advanced 2.8%, the largest yearly increase since March. Together, the reports underscore stubborn inflationary pressure even as growth slows.

The labor market has softened further.

Nonfarm payrolls increased by just 22,000 in August, with federal government and energy sector job losses offsetting modest gains in health care. Unemployment held at 4.3%, while labor force participation remained stuck at 62.3%.

Revisions showed June and July job growth was weaker than initially reported, reinforcing signs of cooling momentum. Average hourly earnings still rose 3.7% year over year, keeping wage pressures alive.

Bond markets have adjusted accordingly. Per data from MarketWatch, 2-year Treasury yield sits at 3.56%, while the 10-year is at 4.07%, leaving the curve modestly inverted. Futures traders see a 93% chance of a 25 basis point cut, according to CME FedWatch.

If the Fed limits its move to just 25 bps, investors may react with a “buy the rumor, sell the news” response, since markets have already priced in relief.

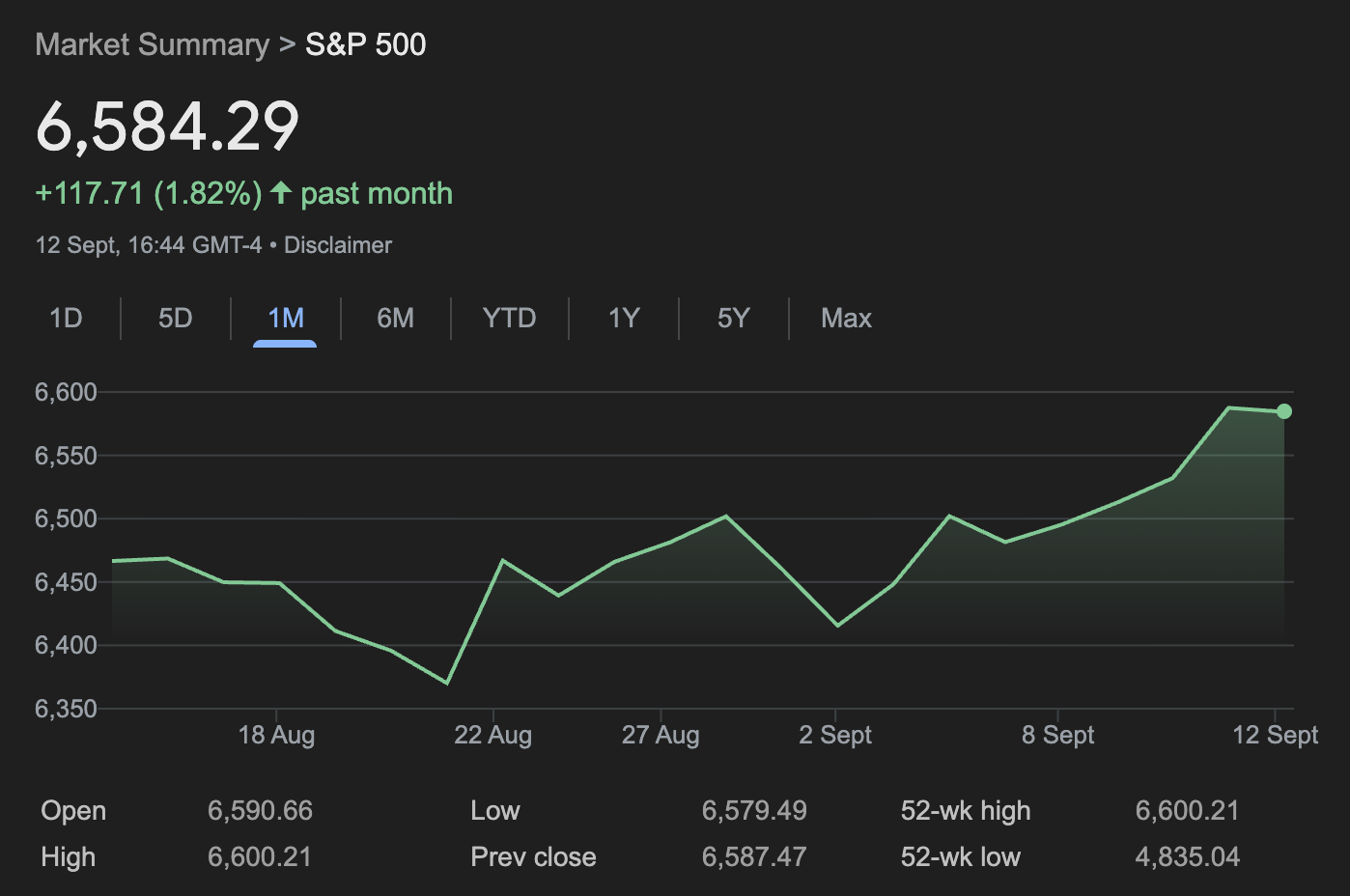

Equities are testing record levels.

The S&P 500 closed Friday at 6,584 after rising 1.6% for the week, its best since early August. The index’s one-month chart shows a strong rebound from its late-August pullback, underscoring bullish sentiment heading into Fed week.

The Nasdaq Composite also notched five straight record highs, ending at 22,141, powered by gains in megacap tech stocks, while the Dow slipped below 46,000 but still booked a weekly advance.

Crypto and commodities have rallied alongside.

Bitcoin is trading at $115,234, below its Aug. 14 all-time high near $124,000 but still firmly higher in 2025, with the global crypto market cap now $4.14 trillion.

Gold has surged to $3,643 per ounce, near record highs, with its one-month chart showing a steady upward trajectory as investors price in lower real yields and seek inflation hedges.

Historical precedent supports the cautious optimism.

Analysis from the Kobeissi Letter — reported in an X thread posted Saturday — citing Carson Research, shows that in 20 of 20 prior cases since 1980 where the Fed cut rates within 2% of S&P 500 all-time highs, the index was higher one year later, averaging gains of nearly 14%.

The shorter term is less predictable: in 11 of those 22 instances, stocks fell in the month following the cut. Kobeissi argues this time could follow a similar pattern — initial turbulence followed by longer-term gains as rate relief amplifies the momentum behind assets like equities, bitcoin and gold.

The broader setup explains why traders are watching the Sept. 17 announcement closely.

Cutting rates while inflation edges higher and stocks hover at records risks denting credibility, yet staying on hold could spook markets that have already priced in easing. Either way, the Fed’s message on growth, inflation, and its policy outlook will likely shape the trajectory of markets for months to come.