A hidden signal from the derivatives market suggests that ether’s (ETH) rally could intensify, lifting valuations quickly to $4,400.

The indicator under consideration is the net gamma exposure of dealers/market makers in the Deribit-listed ether options market. Gamma is the critical metric for options traders, measuring how an option’s delta, or its sensitivity to the underlying asset’s price, changes in response to market moves.

When dealers are short gamma, they are forced to buy the underlying asset as its price rises and sell as its price falls, which often amplifies directional moves. Dealers provide liquidity to the order book and make money from the bid-ask spread while constantly striving to maintain a price-neutral net exposure.

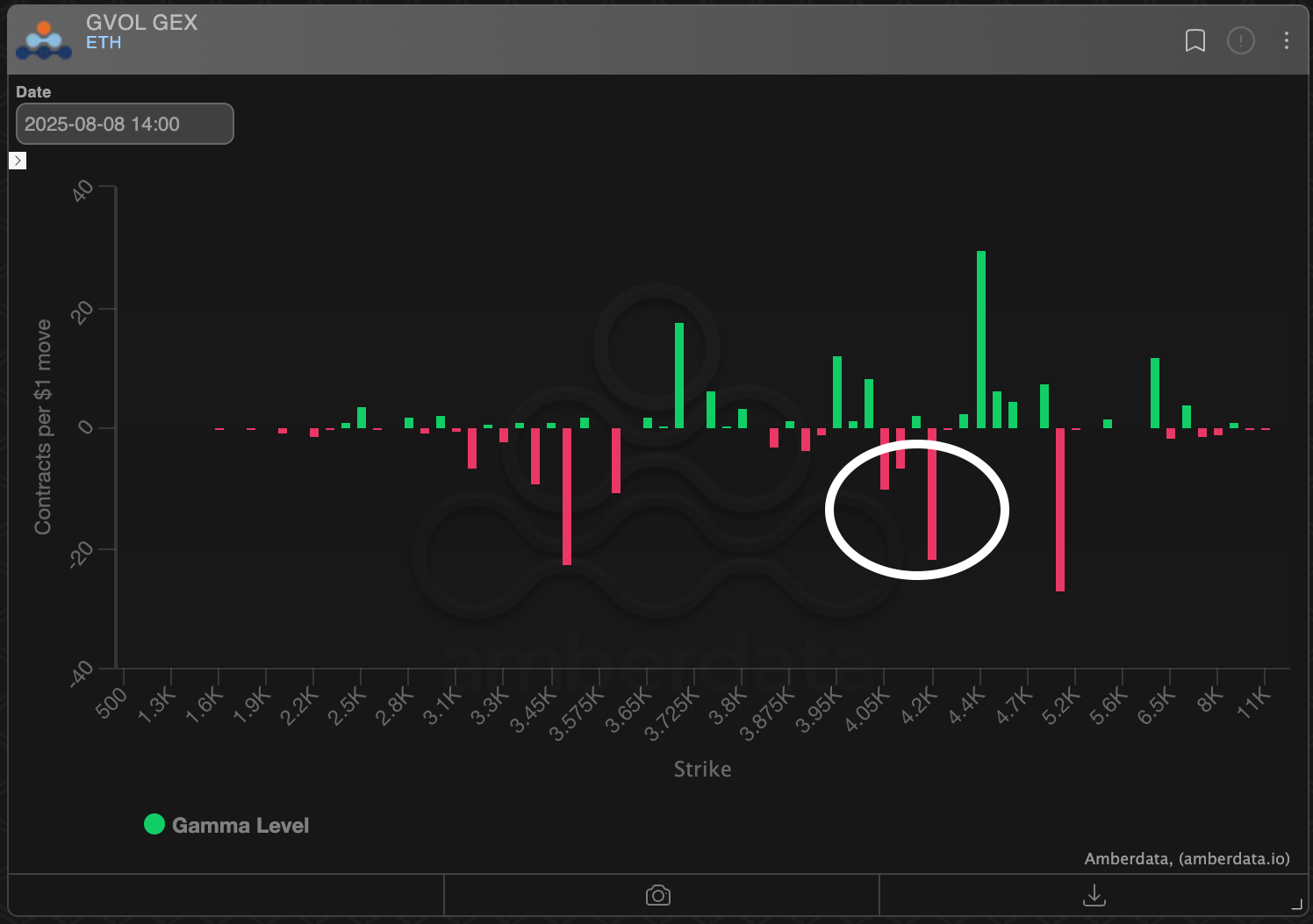

At press time, there was a notable buildup of short gamma between strikes $4,000 and $4,400, according to data source Amberdata. With ether crossing above $4,000, dealers could buy the asset to hedge their exposure, creating a self-reinforcing positive feedback loop that could rapidly propel the price higher to $4,400. That’s a level where the gamma dynamic shifts positive, requiring dealers to trade against the market and arrest the price volatility.

This makes the $4,400 a logical price magnet for the ongoing rally.

“If the momentum in the market is strong enough to get through $4,000, we see dealers also become net buyers of ETH at higher prices, potentially leading to a quick rally to $4,400, the next big gama inventory level,” Greg Magadini, director of derivatives at Amberdata, told CoinDesk.