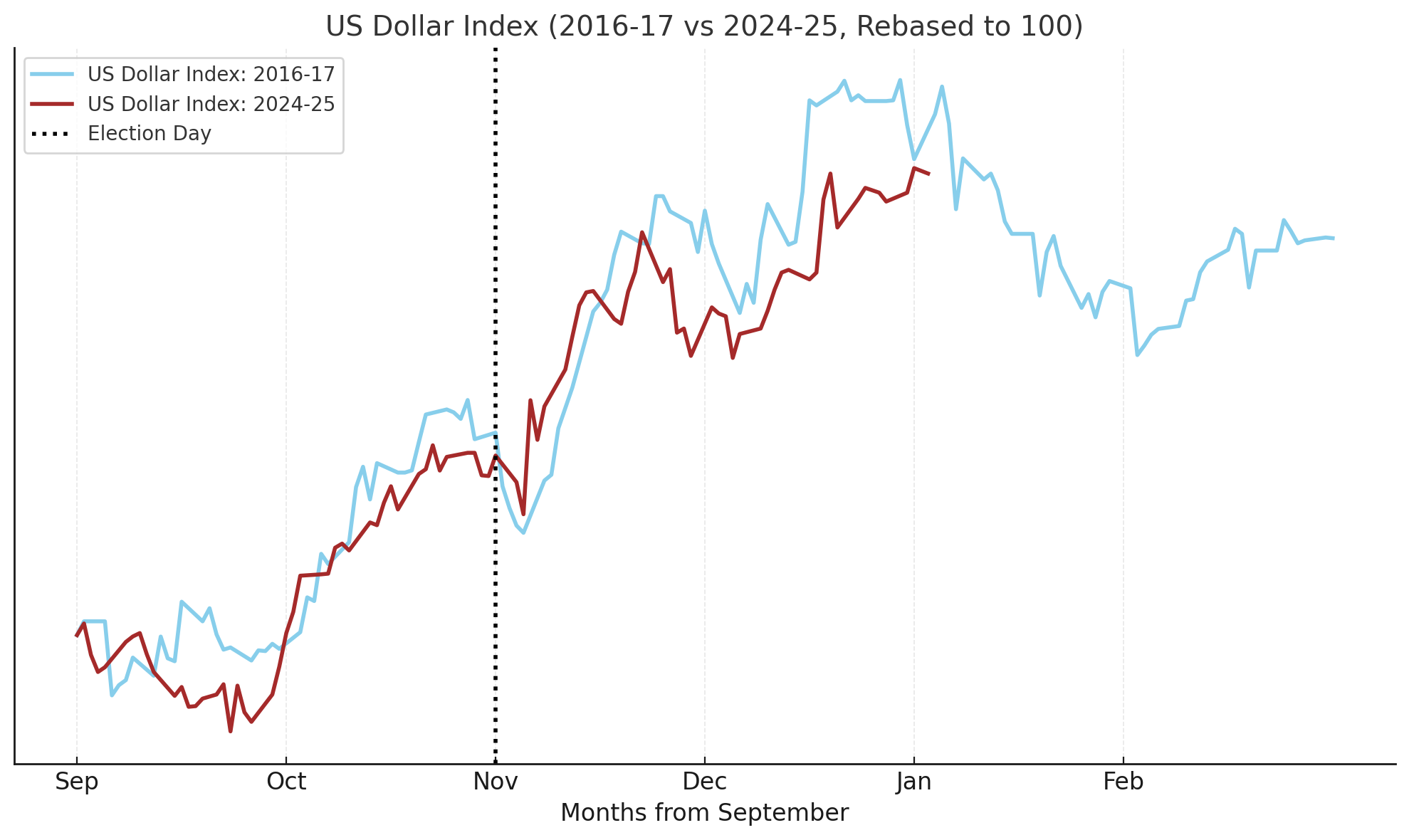

Since U.S. President-elect Donald Trump’s convincing election victory two months ago, the dollar has strengthened more than 3% against its peers, matching its trajectory after his previous win in 2016.

Last time round the DXY Index, which measures the currency’s value against a basket of the U.S.’ major trading partners, peaked in December before trailing off for the next 12 months, coinciding with bitcoin’s (BTC) 2017 bull run.

It’s possible the story will be different this time around. The index has not shown signs of tailing off, and Trump’s economic policies and the Federal Reserve’s actions are likely to underpin the greenback’s rally.

Yet, while a strong dollar is considered negative for risk assets, the incoming president has expressed his support for bitcoin and the largest cryptocurrency has shot up since his election. That rally, which saw it touching multiple record highs, may not continue at quite the same pace, according to Andre Dragosch, Bitwise’s head of research in Europe. BTC is currently priced about 10% below the record of around $108,300 it hit in mid-December.

“The Fed is stuck between a rock and a hard place at the moment,” Dragosch said in an interview over X. “Either risk a U.S. recession by doing too little, too late or risk a significant acceleration in inflation again.”

Trump has vowed to impose tariffs on major trading partners, which has the potential to exacerbate global geopolitical uncertainty, fueling further demand for the dollar, which is perceived as a haven during times of unrest.

We are also seeing strong economic performance from the U.S. compared with other markets, with over 3% growth in gross domestic product (GDP) and higher-than-targeted inflation, which keeps federal funds rates elevated and only two interest-rate cuts forecast for 2025.

The Fed has “communicated to markets that they will do only two cuts in 2025 – significantly less than previously anticipated,” Dragosch said. “That’s why the dollar has been appreciating, and yields have continued to move up. I think that’s what’s been weighing on BTC as well. Macro is a headwind right now.”