Crypto markets saw a rise in volatility on Wednesday as Federal Reserve Chair Jerome Powell’s hawkish remarks rattled leveraged traders.

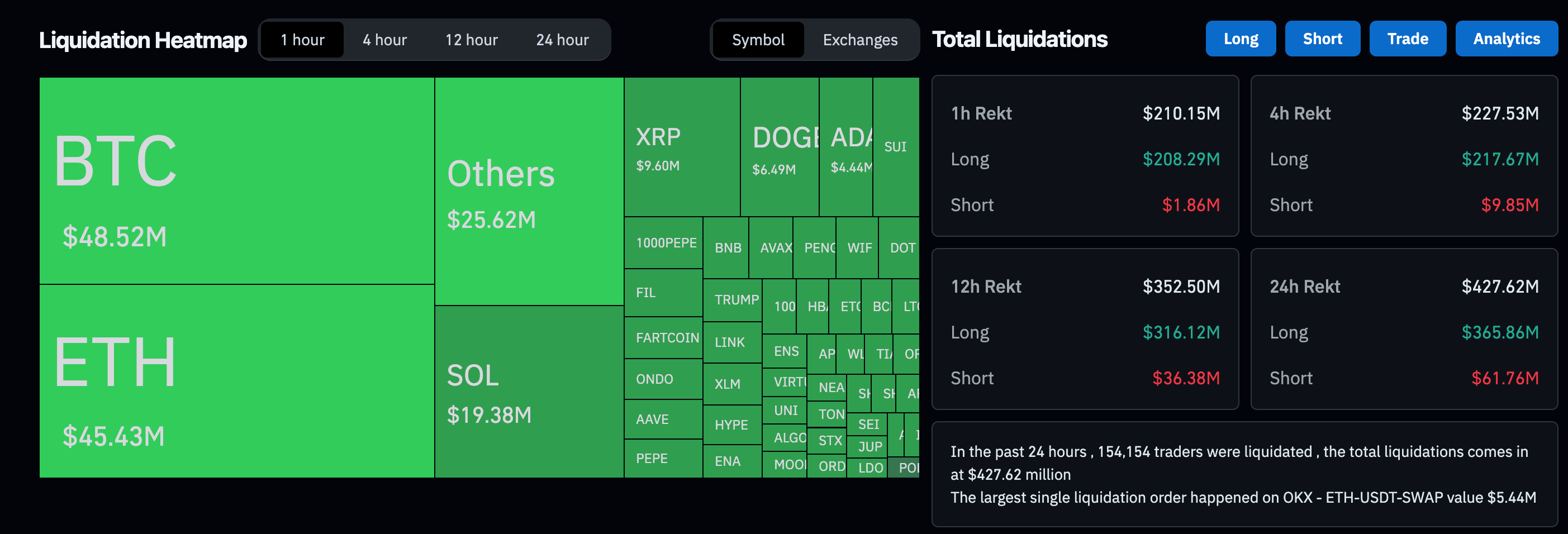

Liquidations spiked to over $200 million in an hour across all digital assets as bitcoin (BTC) dipped below $116,000 while Powell spoke, CoinGlass data shows.

The central bank left interest rates unchanged, with Powell insisting on potential inflationary pressures from tariffs, while two officials dissented in favor of cutting.

Read more: Bitcoin Tumbles Below $116K as Jerome Powell Delivers Hawkish Remarks

Later in the session, BTC bounced back above $117,000, still 0.8% down through the day and trading at the lower end of its three-week tight range. Ether (ETH) slid as much as 3%, then recovered to $3,750, modestly lower (-0.6%) over the past 24 hours.

Altcoins posted steeper declines first, but quickly rebounded. Solana’s SOL (SOL), Avalanche’s AVAX (AVAX) and Hyperliquid’s HYPE tokens were down 4%-5% before paring losses, while BONK and PENGU plunged 10% each before bouncing back.

A check on the traditional market saw Meta (META) and Microsoft (MSFT) posting strong quarterly earnings, lifting the stocks 10% and 6% higher, respectively, after regular trading hours.

“The market is increasingly starting to think the Fed may be behind the curve,” Matt Mena, analyst at digital asset issuer 21Shares, said in a market note.

“Last week’s PCE print marked the second soft reading in a row, and consumer spending is weakening,” he wrote. “With unemployment edging higher and real yields still restrictive, maintaining such tight policy risks overtightening into a broader slowdown.”

The current setup is reminiscent of the last quarter of 2023, Mena said, with “softening inflation, rising political volatility, and a Fed constrained by lagging indicators.”

He said “the stage is set” for the Fed to pivot to lower rates, which could drive BTC to $150,000 by year-end.