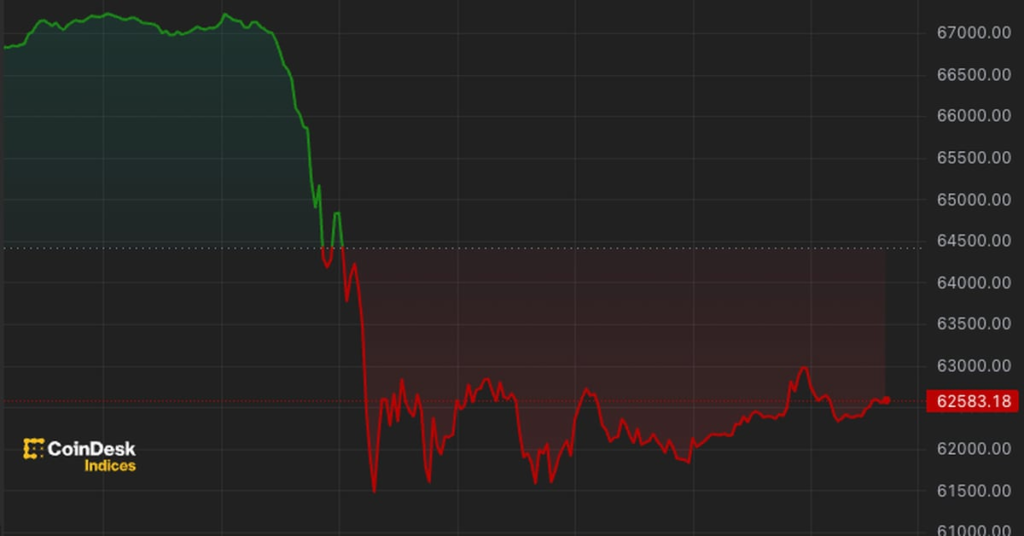

Bitcoin

(BTC)

and

the

broader

cryptocurrency

market

fell

nearly

10%

on

Saturday,

with

the

price

of

the

largest

digital

asset

briefly

falling

below

$62,000

before

recovering

to

around

$64,000

as

of

press

time.

It

wasn’t

alone:

other

major

digital

assets

saw

similar

falls

over

the

past

24

hours,

including

ether

(ETH),

which

fell

7%

to

just

under

$3,000,

BNB

(BNB)

(down

9%)

and

solana

(SOL)

(down

12%),

according

to

CoinGecko.

Trading

volume

has

risen

over

that

same

time

period.

The

decentralized

finance

(DeFi)

sector

has

been

hit

particularly

hard

as

a

result

of

the

market

chaos,

with

depressed

prices

forcing

liquidations

and

raising

the

potential

of

havoc

for

some

protocols.

Among

the

protocols

being

closely

watched

is

Ethena,

the

buzzy

Ethereum

project

behind

USDe,

a

“synthetic

dollar”

built

to

mirror

the

price

of

the

US

dollar.

Ethena

has

attracted

more

than

$2

billion

in

deposits,

but

it

uses

a

controversial

method

for

maintaining

USDe’s

one-dollar

“peg”

that

hasn’t

been

tested

under

such

adverse

market

conditions.

The

immediate

cause

of

Saturday’s

market

declines

was

not

clear,

though

former

BitMEX

CEO

Arthur

Hayes

wrote

in

a

blog

post

last

week

that

dollar

liquidity

would

drop

right

before

tax

payments

are

due

in

the

U.S.

on

April

15

–

this

coming

Monday.

Lower

liquidity

would

lead

to

lower

prices,

he

said.

The

declines

also

came

as

Iran

launched

drone

and

missile

strikes

against

Israel,

in

what

the

Iranian

government

said

was

retaliation

for

an

airstrike

on

its

consulate

in

Damascus,

Syria

that

it

attributed

to

Israel.

Crypto

market

prices

began

to

recover

after

the

X

(formerly

Twitter)

account

associated

with

Iran’s

Permanent

Mission

to

the

United

Nations

said

“the

matter

can

be

deemed

concluded,”

though

it

warned

of

a

“considerably

more

severe”

attack

“should

the

Israeli

regime

make

another

mistake.”