Crypto lending firm Genesis held $5.1 billion in liabilities in the weeks following its freeze on withdrawals in November, according to bankruptcy court documents signed by interim CEO Derar Islim.

This article originally appeared in Crypto Markets Today, CoinDesk’s daily newsletter diving into what happened in today’s crypto markets. Subscribe to get it in your inbox every day.

-

In a first-day motion in the U.S. Bankruptcy Court for the Southern District of New York, Islim provided a breakdown of Genesis’ financial state heading into its restructuring. Genesis became the latest crypto firm caught up in the immediate fallout of FTX’s implosion, with three of its entities – Genesis HoldCo, Genesis Global Capital LLC and Genesis Asia Pacific PTE. LTD – filing for Chapter 11 bankruptcy protection late Thursday.

-

Those entities were perhaps less affected by direct losses to FTX and sister company Alameda than by the “run on the bank” that Islim said their collapse sparked. Customers demanded Genesis repay $827 million in loans, forcing its lending units to freeze withdrawals.

-

“At the same time, Holdco’s corporate parent, Digital Currency Group (DCG), and its various subsidiaries, including DCG International Investments Ltd., were also impacted by the market turmoil and did not have the liquidity to pay back the Company on certain loans, adding pressure to the Debtors’ balance sheets,” Islim said. (DCG is also the parent of CoinDesk.)

-

At least part of the liquidity crunch began months earlier thanks to Genesis’ $1.2 billion loss to crypto hedge fund Three Arrows Capital (3AC), which collapsed in the summer of 2022. That loss came out of the Genesis Asia Pacific unit (that also filed for bankruptcy), which managed Genesis’ lending relationship with 3AC. At the time of 3AC going under, Genesis had $2.4 billion in outstanding loans to the fund, of which Genesis was able to recover just half, according to the filing.

-

DCG last year assumed much of that exposure, swapping a 10-year promissory note in exchange for Genesis’ $1.2 billion in claims against 3AC. That note is now at the center of DCG’s public spat with crypto exchange Gemini over the exchange’s yield product Earn, with Gemini being Genesis’ largest creditor at more than $700 million.

(CoinDesk Research)

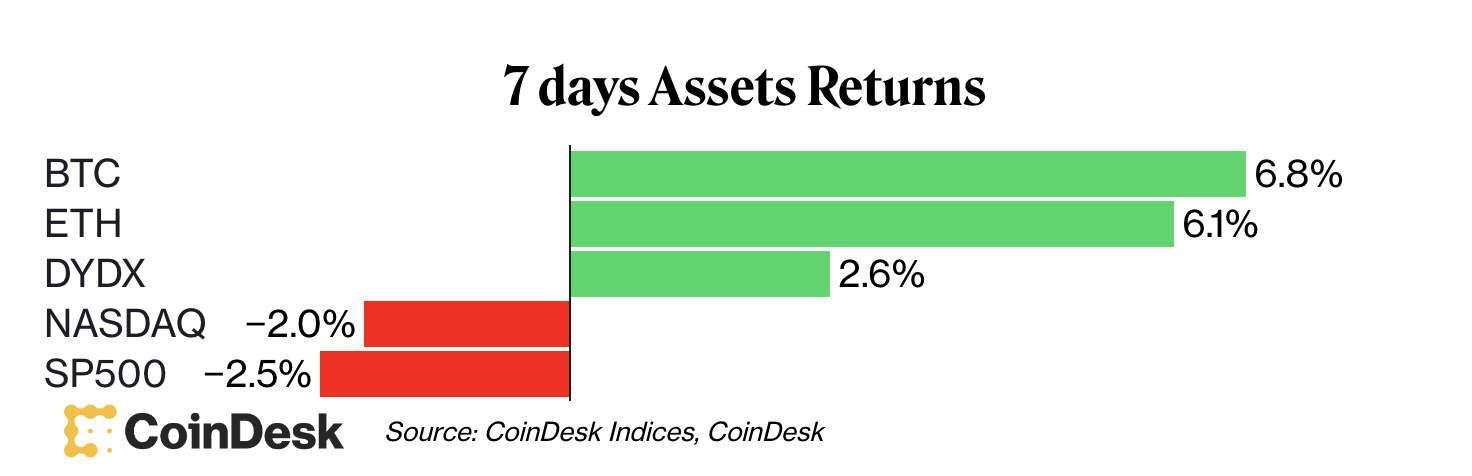

Bitcoin (BTC) and ether (ETH): The largest cryptocurrency by market value surged above $22,000, and was recently trading as high as $22,419 Friday, its highest level since mid-September. At the time of publication, it was up 6% over the past 24 hours.. Ether was recently trading up 5.7% to $1,640.

Equities closed higher as investors processed a flurry of mixed earnings reports from big banks. The tech-heavy Nasdaq Composite rose 2.6%, while the S&P 500 and the Dow Jones Industrial Average (DJIA) were up 1.8% and 1.0%, respectively.

dYdX (DYDX): Perpetuals-focused decentralized exchange dYdX is set to unlock 150 million, or about $200 million worth, of its native token, DYDX, on Feb. 2. The supply release, however, isn’t necessarily bearish, some analysts said, cautioning against making short bets in the derivative market tied to the cryptocurrency. The DYDX token was recently trading at $1.5, up 13% over the previous 24 hours.

1,063.52

+62.6 ▲ 6.3%

$22,393

+1394.5 ▲ 6.6%

$1,638

+88.3 ▲ 5.7%

S&P 500 daily close

3,972.61

+73.8 ▲ 1.9%

Gold

$1,928

+5.6 ▲ 0.3%

Treasury Yield 10 Years

3.48%

▲ 0.1

Crypto Market Analysis: Bitcoin, Ether Top Weekly Leaderboard, but Some Indicators Suggest a Market Retreat

By Glenn Williams Jr.

Crypto markets were trading higher on Friday. Markets were seemingly unaffected by the announcement that crypto lender (and CoinDesk sister company) Genesis had filed for Chapter 11 bankruptcy protection.

Trading volumes were moderate for the day, indicating that some investors may simply be pausing as smoke from the bankruptcy announcement clears.

Next week, investors may want to look for BTC returning some of this week’s gains.

On a technical basis, BTC has failed to reach the upper range of its Bollinger Bands for three consecutive trading days after doing so in each of the prior 10. The decline in volatility following the prior expansion, could be signs that traders are:

-

Looking to take profits following the 30% year-to-date move

-

Looking to protect against price declines related to the Genesis filing

Bitcoin 1/20/23 (TradingView)

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.