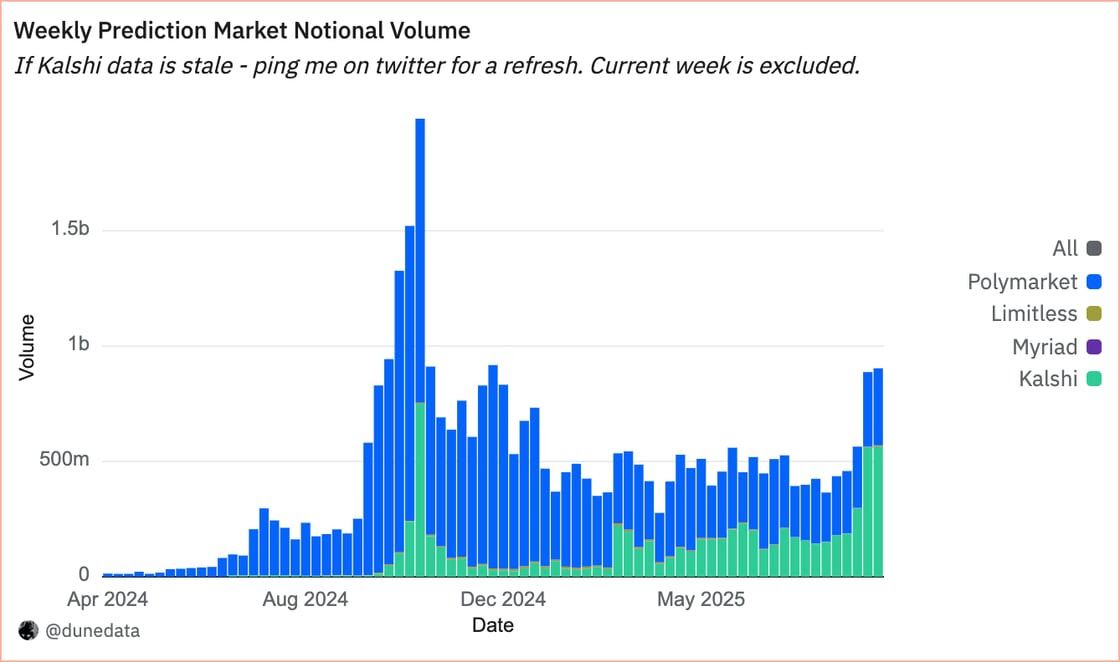

Kalshi is pulling ahead in the prediction market race, capturing a dominant share of trading volume even as competitors like Polymarket push into regulated U.S. territory.

From Sept. 11 to 17, Kalshi accounted for 62% of total volume in the on-chain prediction market sector, according to data from Dune Analytics, while Polymarket’s stood at 37%. The former’s weekly trading pace topped $500 million, with an average open interest of around $189 million.

Its volume is beyond that of Polymarket, which stood at $430 million, and its average open interest of $164 million, which implies “sticker positions on Polymarket and faster turnover on Kalshi.”

Polymarket’s longer-term markets, which often stretch over weeks or months, keep user funds locked in for longer periods, essentially.

This shows up in the open interest-to-volume ratio: Polymarket averaged 0.38, while Kalshi sat lower at 0.29. That suggests Kalshi’s users are trading more often, while Polymarket’s positions tend to sit.

Still, Polymarket is building out a greater position in the U.S. The platform has cleared its acquisition of QCX, a regulated derivatives exchange, to enter the country again.

It has also launched earnings-based markets with social investing platform Stocktwits, designed to let stockholders hedge earnings risk and analysts gauge market sentiment in real time.

Read more: Polymarket Weighs $9B Valuation Amid User Surge and CFTC Approval: The Information