“Hyperbitcoinization” — an almost apocalyptic term evoking end-of-days fiat collapse and bitcoin’s parabolic rise to global reserve status — is increasingly being discussed in more serious circles.

For hardcore bitcoin maximalists, it’s long been the ultimate scenario: a financial utopia where individuals, institutions and even nations are all-in on a bitcoin-only system as the fiat-based economy collapses.

While we aren’t there yet, the recent events might suggest something is brewing.

Bitcoin is trading at record highs above $119,000. The market cap of bitcoin is near that of the tech giants. The U.S. dollar is continuing its slow bleed in real purchasing power. Major institutions are allocating capital to BTC with the same risk-adjusted lens they apply to traditional assets. If hyperbitcoinization once sounded like ideological fiction, it’s now likely approaching early-stage reality.

“In prior BTC bull markets, the hyperbitcoinization thesis would have been limited to crypto enthusiasts. More recently, hyperbitcoinization-adjacent conversations have become much more palatable for the broader public,” FRNT Capital said in an emailed note.

From trenches to the front line

Just a few years ago, no one thought the likes of BlackRock would be creating an exchange-traded fund for the masses to buy billions in bitcoin.

Today, the iShares Bitcoin Trust (IBIT) is a juggernaut with 706,008 bitcoin under its belt, worth $82 billion, according to BitcoinTreasuries.Net data.

Large companies are raising funds to buy bitcoin for their balance sheets. Political leaders, including a pro-crypto U.S. president, are floating the idea of national bitcoin reserves (whether that will come to fruition is still up for debate).

Even a U.S. housing regulator is considering whether crypto holdings could be considered for mortgage applications — a potential signal that digital assets are becoming part of core financial infrastructure, or at least that those currently in power would like to see that happen.

And of course, Wall Street has already claimed bitcoin with “Tradification” of the digital assets.

The ownership shift

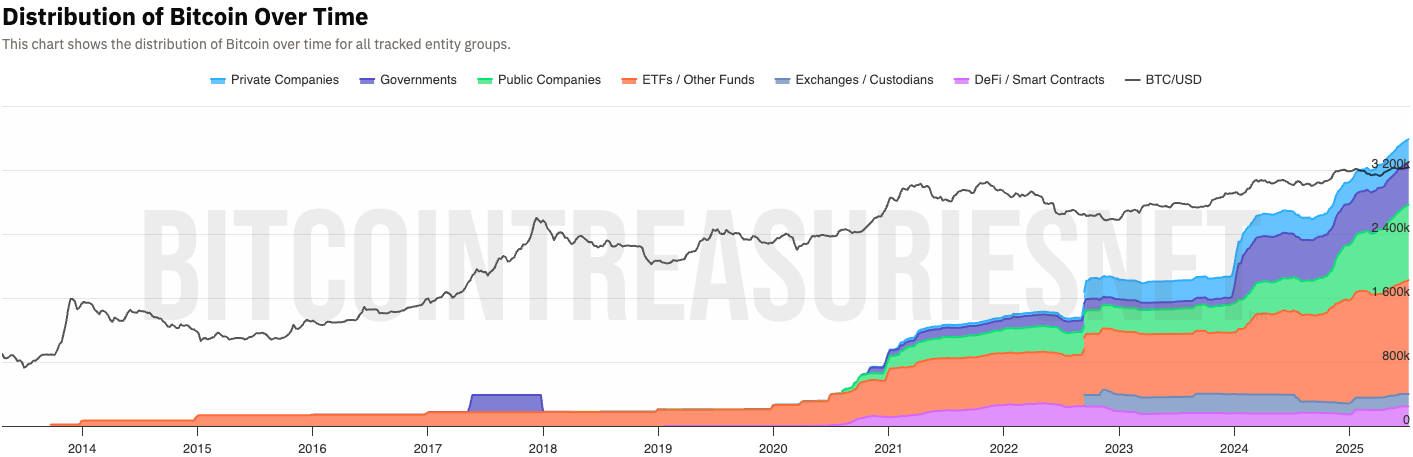

The chart below makes an interesting observation about a potential “hyperbitcoinization” that may already be well underway.

From 2014 till at least 2020, bitcoin has been held by mostly individuals. But fast forward to today, a massive number of companies, funds and even governments, as opposed to individual crypto enthusiasts, are holders of bitcoin while prices continue to rally to new highs.

This shift in wallet distribution suggests that hyperbitcoinization, while not fully realized, is progressing from an ideological thesis to a potential observable market behavior.

In a market that is increasingly driven by narrative momentum and liquidity rotation, hyperbitcoinization may not just be a theme — it might become the trade.

“Conceivably, as the hyperbitcoinization thesis is validated in practice and gains further mainstream attention, more BTC investors will be motivated to HODL. This does not apply just to individuals, but to institutions and nations alike,” said FRNT.