Adopting Michael Saylor’s strategy of buying for the balance sheet has clearly taken off among many publicly traded firms, substantially enriching their stock prices and shareholders.

But what does it mean for the future of the bitcoin price? NYDIG Research crunched the numbers, and the results are striking.

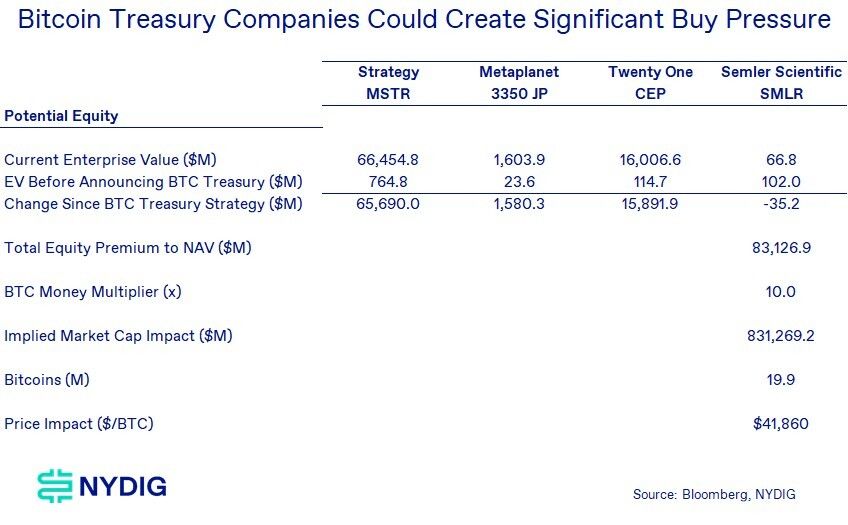

“If we apply a 10x “money multiplier”—a rule of thumb reflecting the historical impact of new capital on bitcoin’s market cap—and divide by the total supply of bitcoin, we arrive at a rough estimate of the potential price impact: a nearly $42,000 increase per bitcoin,” NYDIG said in a research report.

To reach this conclusion, the analysts at NYDIG reviewed Strategy (MSTR), Metaplanet (3350), Twenty One (CEP), and Semler Scientific’s (SMLR) cumulative equity valuation since they adopted the bitcoin buying strategy. This gave the analysts an outline of how much money they could theoretically raise by issuing shares at current stock prices to buy more bitcoin.

If this analysis comes true, the projected price is nearly a 44% increase from the current spot price of $96,000 per bitcoin. If capitalized, Wall Street money managers perhaps wouldn’t mind showing this PnL chart to their clients, especially given the current volatility and uncertainty in the market.

“The implication is clear: this ‘dry powder’ in the form of issuance capacity could have a significant upward effect on bitcoin’s price,” NYDIG Research said.

Bitcoin’s limited supply also bodes well for the analysis. Publicly-traded companies already hold 3.63% of bitcoin’s total supply, with the lion’s share of those coins being held by Strategy. Adding private company and government holdings, the total is at 7.48% according to BitcoinTreasuries data.

Demand could also grow further in the near future if the U.S. government finds “budget-neutral strategies for acquiring additional bitcoin” for its strategic bitcoin reserve.

Read more: Cantor Skyrockets 130% as Traders FOMO Into the Stock on Bitcoin SPAC Frenzy