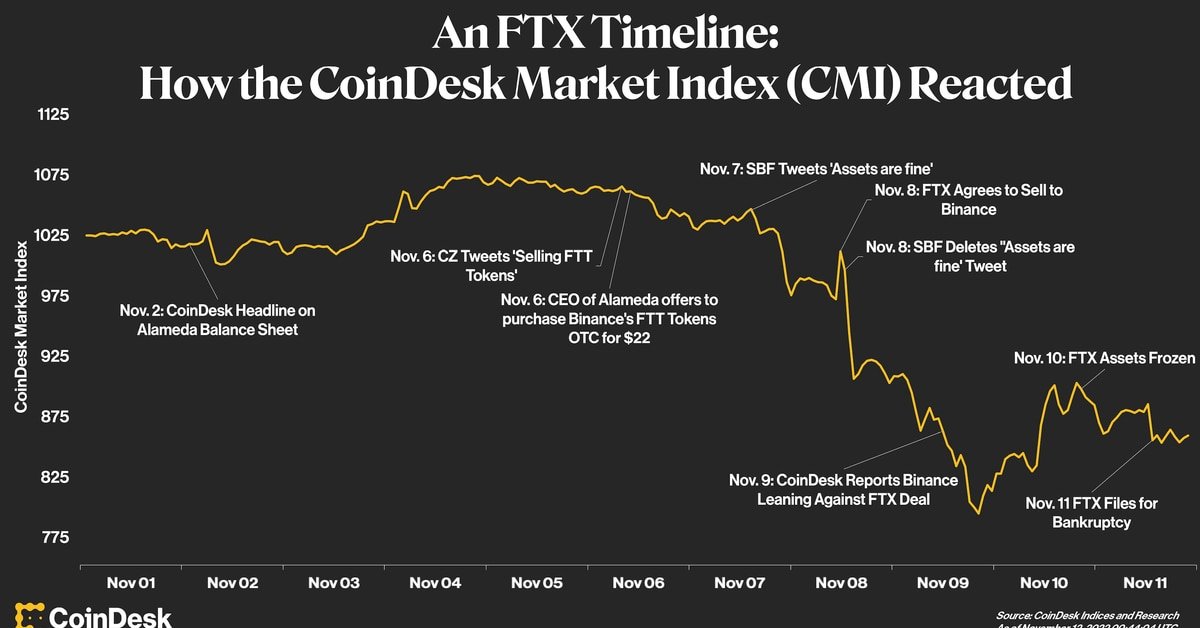

After this week’s shocking (and still-unfolding) developments in the crypto industry, including the rapid unraveling of Sam Bankman-Fried’s FTX exchange and Alameda Research trading firm, analysts with CoinDesk Indices worked with CoinDesk journalists to put together an annotated chart of the movements in the 162-asset CoinDesk Market Index (CMI).

The chart (featured above) shows how digital-asset traders scrambled to keep up.

Here’s a timeline of the events:

Nov. 2: CoinDesk publishes exclusive revealing key balance-sheet details of Sam Bankman-Fried’s Alameda Research trading firm, showing it’s heavily invested in the FTX exchange’s FTT token.

Nov. 6: Binance CEO Changpeng “CZ” Zhao says he’s selling his remaining holdings of FTT tokens. (Minutes later, Caroline Ellis, CEO of Alameda Research, tweets that Alameda will buy Zhao’s FTT tokens for $22 each.

Nov. 8: The FTT token price falls below $22.

Nov. 8: Binance announces non-binding letter of intent to buy FTX, subject to due diligence, easing the industry panic.

Nov. 9: CoinDesk is first to report Binance is strongly leaning against buying FTX after just a few hours of checking its books and loans.

Nov. 9: Binance officially walks away from the FTX deal.

Nov. 9: Without details, Justin Sun drops hints at saving FTX.

Nov. 10: Bankman-Fried says Alameda Research, the trading firm at the center of the drama, is being wound down.

Nov. 10: FTX assets frozen by Bahamian regulator.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.