This

week

in

prediction

markets

-

Do

prediction

markets

have

a

pro-Trump

bias?

Or

do

they

just

put

a

premium

on

the

front-runners? -

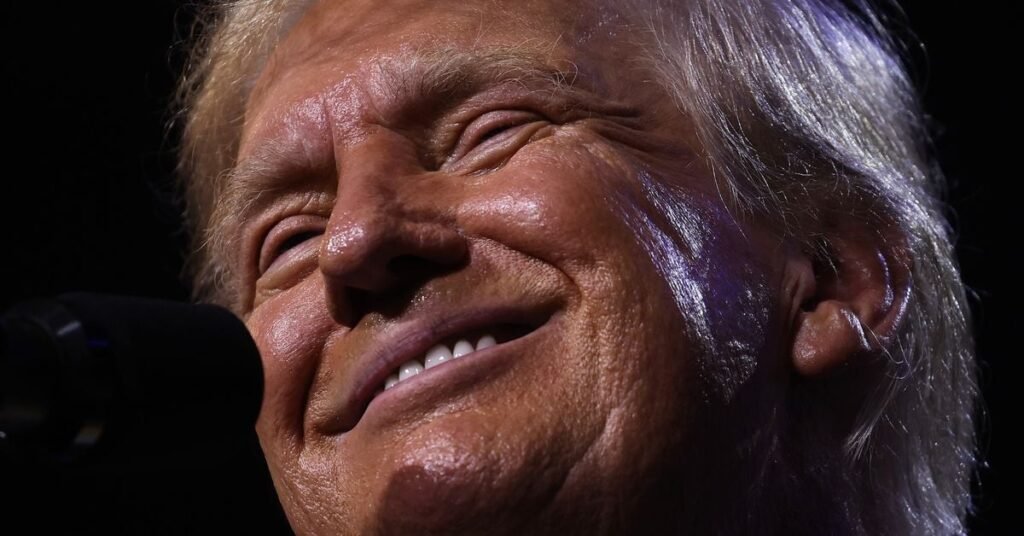

Trump

and

Biden

will

likely

debate,

while

Trump

won’t

be

charged

with

another

felony,

Polymarket

prices

signal. -

Kalshi

bettors

place

Coinbase

volume

above

last

quarter’s.

If

traders

on

Polymarket

are

right,

and

there’s

$165

million

bet

on

the

question,

the

2024

U.S.

presidential

election

will

be

a

blowout

for

the

ages.

With

a

56%

chance

of

winning,

former

president

Donald

Trump

has

a

22-percentage-point

lead

over

incumbent

Joe

Biden,

according

to

the

crypto-based

platform’s

officially

non-American

bettors

(as

part

of

a

settlement

with

the

Commodity

Futures

Trading

Commission,

Polymarket

agreed

to

geo-block

U.S.-based

users).

Contrast

that

to

an

aggregate

of

polls

prepared

by

Nate

Silver’s

FiveThirtyEight,

which

gives

Trump

a

mere

one-point

lead.

Some

might

be

quick

to

attribute

the

huge

gap

to

the

fact

that

Polymarket

users

are,

by

definition,

crypto

users,

and

therefore

might

be

biased

toward

him.

They

might

note

that

on

PredictIt,

a

more

traditional

prediction

market

platform

settled

in

U.S.

dollars,

Trump

is

leading

50-45:

Still

a

wider

margin

than

the

polls,

but

nowhere

near

as

dramatic

as

only

Polymarket.

Trump,

after

all,

is

the

pro-crypto

candidate.

There’s

also

the

crypto

community’s

love

of

a

troll:

Trump-themed

“PoliFi”

tokens

have

a

higher

market

cap

than

their

Biden

counterparts.

On

the

other

hand,

these

traders

are

betting

on

what

will

happen,

not

what

they

want

to

happen.

So

they

are

highly

incentivized

to

research

and

make

informed

decisions,

regardless

of

their

political

preferences.

In

theory,

at

least,

these

markets

should

be

a

more

reliable

gauge

of

sentiment

than

polling,

and

perhaps

a

superior

forecasting

method

as

well.

Indeed,

Ryan

Selkis,

founder

of

crypto

research

outfit

Messari,

claimed

in

a

recent

tweet

that

the

Trump

campaign

has

been

giving

their

candidate

Polymarket

numbers

on

top

of

the

usual

polling

readout,

because

the

team

is

heavily

skeptical

of

polls

in

general.

Remember:

in

prediction

markets,

those

who

bet

on

the

correct

outcome

receive

$1

per

share,

while

those

who

bet

wrong

get

nothing,

with

share

prices

reflecting

probabilities.

A

share

trading

at

40

cents

indicates

a

40%

chance

of

success,

for

example.

Another,

more

banal

explanation

of

Trump’s

outsized

odds

on

Polymarket

is

that

traders

there

tend

to

put

a

high

premium

on

any

leading

candidate,

way

ahead

of

the

polls.

Look

at

other

recent

elections

where

there

was

a

gulf

between

Polymarket

and

the

polls.

Ahead

of

Taiwan’s

Jan.

13

election,

Polymarket

gave

the

Democratic

Progressive

Party’s

Lai

Ching-te

a

60%

to

70%

chance

of

winning,

even

though

his

polling

numbers

were

only

in

the

high

20s

to

low

40s.

Lai

won

with

40%

of

the

vote.

In

the

run-up

to

Indonesia’s

election

in

February,

Polymarket

put

Prabowo

Subianto’s

chances

of

winning

in

the

high

70s,

while

his

polling

numbers

were

in

the

high

50s.

He

won

with

55%.

There

are

a

lot

of

other

factors

at

play

in

Trump’s

high

odds

on

Polymarket.

Traders

are

heavily

discounting

independent

candidate

Robert

F.

Kennedy,

Jr.

at

around

2%

probably,

while

538’s

poll

aggregation

has

him

closer

to

9%.

Similarly,

in

Taiwan’s,

the

presence

of

a

third-party

potential

spoiler

in

the

form

of

the

newly

established

People’s

Party,

led

by

Taipei’s

former

mayor

Ko

Wen-je,

added

some

complexity

to

the

model

as

Polymarket

gave

the

TPP

lower

probability

than

its

polling

numbers.

So

is

the

Polymarket

premium

a

predictive

force

or

an

online

flex

for

Trump

fans?

We’ll

have

much

better

data

to

answer

that

question

after

the

November

ballot

result.

Debate

Is

Likely;

Another

Conviction

Isn’t

Trump,

ever

the

showman,

is

said

to

be

thrilled

about

taking

the

stage

against

Biden

for

the

first

Presidential

election

debate

scheduled

for

later

this

month.

So

thrilled

that

his

campaign

is

calling

for

more:

four

debates

as

opposed

to

the

two

proposed

by

the

Biden

camp.

There’s

a

growing

narrative,

however,

that

Trump

will

ghost

the

debates

entirely

if

he

doesn’t

get

his

way

about

formats

and

other

specifics.

In

an

interview

in

late

May,

Democratic

strategist

James

Carville

suggested

that

Trump

won’t

show

up

to

the

debates

if

he

doesn’t

think

doing

so

is

in

his

own

self-interest.

“I

don’t

think

Trump

will

go

to

the

debate,”

Carville

said

in

an

interview

with

neoconservaitve

commentator

Bill

Kristol.

“He

doesn’t

do

anything

that’s

not

in

his

perceived

self-interest,

and

this

is

one

of

these

things

where

he

could

hurt

—

Biden

has

a

chance

to

help

himself.”

The

market

seems

to

be

dismissing

Carville’s

prediction,

giving

the

debate

a

77%

chance

of

going

on

as

scheduled.

Meanwhile,

news

that

Trump’s

other

felony

trials

are

stuck

in

bureaucratic

limbo

means

that

the

market

is

only

pricing

in

a

14%

chance

that

he’ll

appear

before

a

court

–

and

be

convicted

again

–

prior

to

the

election

in

November.

Are

Retail

Traders

Reaping

Crypto’s

Riches?

Coinbase

is

set

to

report

quarterly

earnings

on

June

14,

and

a

closely

watched

metric

will

be

the

crypto

exchange’s

trading

volume,

a

measure

of

retail

investors’

market

participation.

Coinbase,

of

course,

isn’t

all

retail.

It

has

a

large

institutional

business,

but

the

licensed

exchange

with

reliable

banking

on-

and

off-ramps

is

a

bellwether

for

retail

trading.

Its

mobile

app’s

position

in

Apple’s

top

100

free

app

section

has

been

a

popular

indicator

of

retail’s

participation

in

the

crypto

market.

Over

at

Kalshi,

the

lone

U.S.-regulated

prediction

market

platform,

a

contract

asking

bettors

to

forecast

Coinbase’s

trading

volume

has

it

coming

in

at

$174

billion,

higher

than

the

$154

billion

Coinbase

posted

at

the

end

of

its

last

quarter

in

February.

With

the

wreckage

of

FTX

cleaned

up,

a

big

narrative

trend

has

been

the

institutionalization

of

crypto.

There’s

a

lot

to

be

said

as

to

why

this

is

a

positive

development

for

crypto,

as

endorsements

by

the

world’s

largest

fund

managers,

such

as

BlackRock

and

Fidelity,

in

the

form

of

exchange

traded

fund

(ETF)

products

are

an

indicator

that

the

asset

class

isn’t

a

fly-by-night

operation

ready

to

rug

pull

investors.

At

the

same

time,

it

can

be

argued

that

a

heavily

institutionalized

asset

class

is

antithetical

to

the

vision

of

Satoshi

Nalamoto,

who

wrote

the

bitcoin

white

paper

in

the

aftermath

of

the

2008

financial

crisis

when

these

same

institutions

torpedoed

the

global

economy.

In

the

time

since

Coinbase’s

last

earnings

report,

bitcoin

is

up

around

45%,

according

to

CoinDesk

Indices

data.

Kalshi

bettors

are

plotting

just

a

13%

increase

in

Coinbase’s

trading

volume

for

the

same

period.

Whom

are

the

spoils

of

this

bull

market

going

to?