Ailing Silvergate Capital’s decision to shutter its instant settlement service SEN, which was popular among large investors, will boost the role of stablecoins and their issuers in crypto trading, market research firm Kaiko said in a report published Monday.

Silvergate is a key banking partner to many digital asset firms, and its SEN platform has been a widely used vehicle for institutional investors to send money to crypto exchanges. As the bank delayed filing its annual report last week and warned about possible regulatory inquiries, multiple firms, including Coinbase, Circle, Paxos, Binance.US, Galaxy Digital and Gemini suspended transfers and operations with Silvergate.

“With the death of SEN, stablecoins will likely become even more ubiquitous among traders,” the Kaiko report said.

Instead of depositing dollars to crypto exchanges using banking rails, Kaiko predicts that traders will transfer money to stablecoin issuers to get stablecoins, and then deposit stablecoins to exchanges.

“The problem is, though, that stablecoin issuers still need access to a crypto bank, so the risk is now further concentrated,” the report added.

Decline of U.S. dollars in trading

Stablecoins such as Tether’s USDT and Circle’s USDC have become the cornerstone of crypto markets, replacing government-issued fiat currencies such as the U.S. dollar to buy and sell cryptocurrencies. The number of fiat trading pairs has declined globally as stablecoins have grown, Kaiko said.

Of particular note, the role of the U.S. dollar in crypto trading has been dropping steadily. Last year, the number of new dollar trading pairs on exchanges fell to 326 from 400 in 2021, Kaiko data shows.

“Since the FTX collapse, USD market share has fallen consistently relative to USDT, USDC, and euro trading pairs,” the report said.

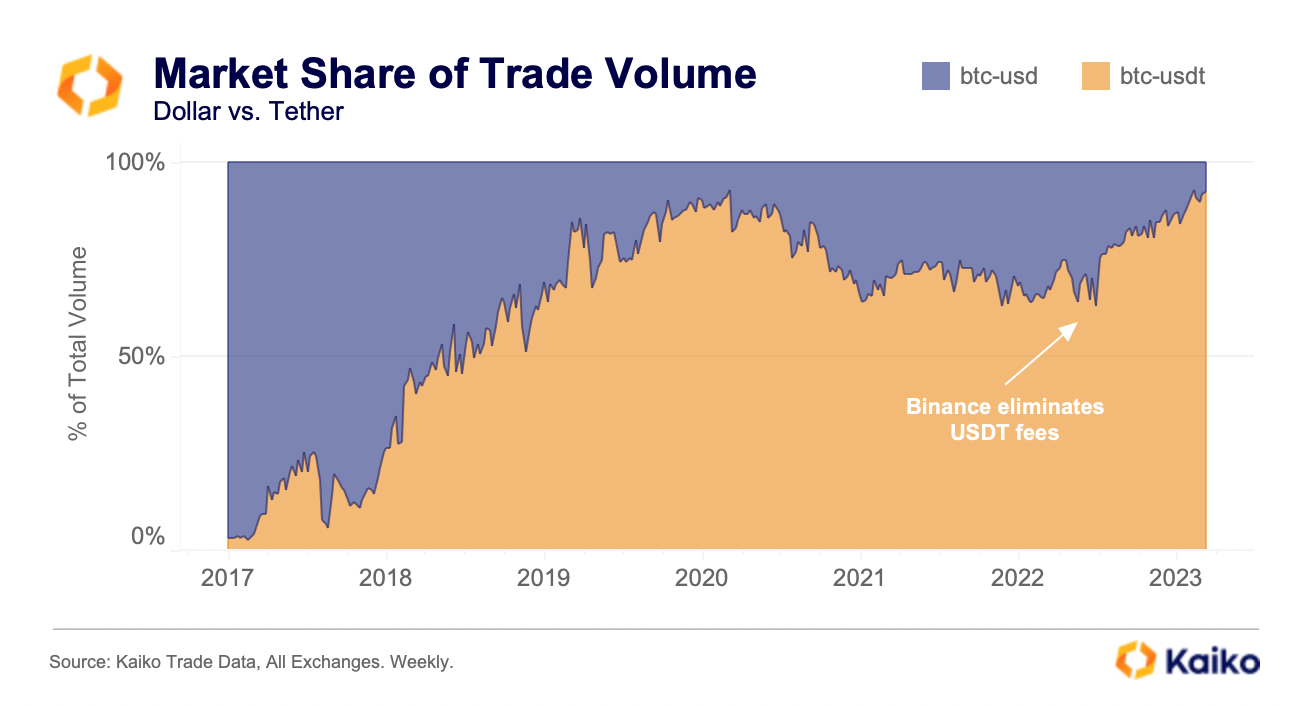

For instance, USDT’s dominance in bitcoin (BTC) trading volumes has recently reached an all-time high of 93% versus the U.S. dollar, according to Kaiko, a spectacular rise from only 3% in 2017.

The rising dominance of Tether’s USDT stablecoin in the bitcoin trading volume epitomizes the U.S. dollar’s decline in crypto trading. (Kaiko)

“For now, the dollar and dollar-pegged stablecoins remain the foundation of the crypto-economy, but growing complications with USD payment rails could upend this trend,” the report said.

Read more: Crypto’s Banking Problem Is Not Ironic

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)