-

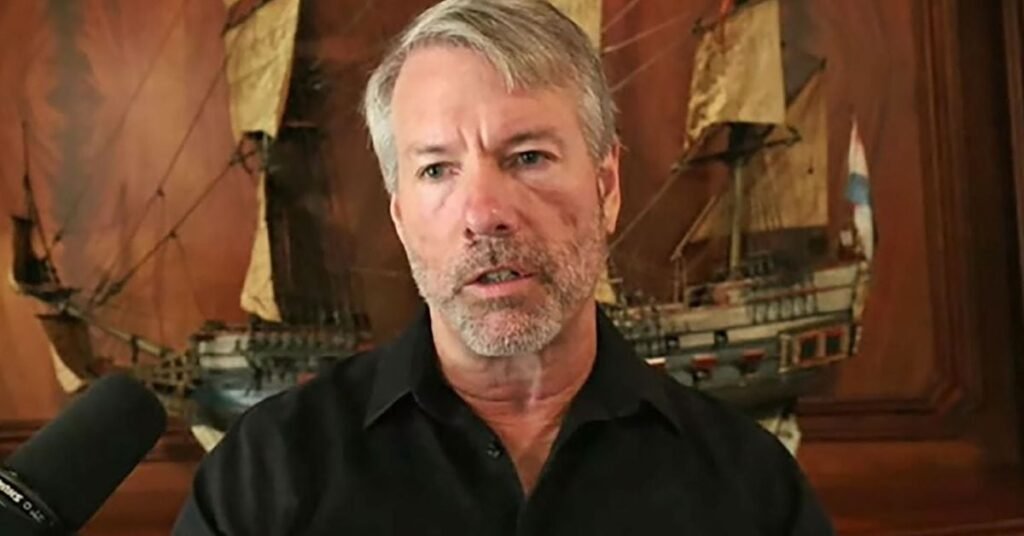

Bitcoin

maximalist

Michael

Taylor

is

not

selling

any

of

his

company’s

bitcoin

anytime

soon. -

“There’s

no

reason

to

sell

the

winner

and

buy

the

losers,”

he

said

in

an

interview

with

Bloomberg

TV

on

Tuesday. -

Bitcoin

competes

with

far

larger

asset

classes

like

gold,

real

estate

and

the

S&P,

but

it’s

the

superior

product,

argued

Saylor.

Michael

Saylor

doesn’t

plan

to

sell

any

of

MicroStrategy’

(MSTR)s

bitcoin

(BTC)

anytime

soon,

or

potentially

ever,

he

said

in

an

interview

with

Bloomberg

TV

on

Tuesday.

“The

spot

ETFs

have

opened

up

a

gateway

for

institutional

capital

to

flow

into

the

bitcoin

ecosystem,”

said

Saylor.

“[The

ETFs]

are

facilitating

the

digital

transformation

of

capital,

and

every

day

hundreds

of

millions

of

dollars

of

capital

is

flowing

from

the

traditional

analog

ecosystem

into

the

digital

economy.”

Saylor’s

MicroStrategy

held

190,000

bitcoins

at

the

end

of

January

which

it

bought

for

an

average

of

$31,224

per

coin.

With

bitcoin

now

trading

at

roughly

$52,000,

the

company’s

holdings

are

worth

about

$10

billion,

with

$4

billion

of

that

profit.

Many

investors

might

be

considering

an

exit

at

this

point,

but

not

Saylor.

“Bitcoin,”

he

told

Bloomberg,

“is

the

exit

strategy.”.

Bitcoin’s

value,

currently

just

over

a

trillion

dollars,

is

competing

with

asset

classes

such

as

gold,

real

estate

or

even

the

S&P

index

–

all

of

which

have

market

capitalizations

many

multiples

higher

than

bitcoin,

said

Saylor.

And

bitcoin,

argued

Saylor,

is

superior

to

all

of

them.

“We

believe

capital

is

going

to

keep

flowing

from

those

asset

classes

into

bitcoin

because

bitcoin

is

technically

superior

to

those

asset

classes

and

that

being

the

case,

there’s

just

no

reason

to

sell

the

winner

and

to

buy

the

losers,”

he

said.

MicroStrategy

first

started

purchasing

bitcoin

in

August

2020

and

has

since

consistently

added

to

its

portfolio.

The

software

firm

alongside

its

fourth

quarter

earnings

report

rebranded

itself

a

“bitcoin

development

company,”

doubling

down

on

its

commitment

to

the

cryptocurrency.

MSTR

shares

are

up

11.8%

year-to-date.