The U.S. Federal Reserve (Fed) on Sunday announced it had joined hands with other major central banks to ensure a steady flow of the U.S. dollar, a dominant reserve currency, in the global financial system.

The Fed said it would increase the frequency of the dollar swap lines with the European Central Bank, the Bank of Japan, the Bank of England, the Bank of Canada and the Swiss National Bank from weekly to daily, starting Monday. The dollar swap lines allow foreign central banks to borrow U.S. dollars while protecting the Fed from downside risks. In a swap, a Foreign central bank swaps its own currency for an equivalent amount of U.S. dollars from the Fed at the market exchange rate. After a pre-determined time, the bank returns the dollars it borrowed, with interest, to the Fed.

The move is aimed at calming exchange rate volatility and avoiding strains in the supply of credit to households and businesses worldwide. It comes on the heels of blowups of three banks in the U.S. and the takeover of troubled Swiss-lender credit Suisse by UBS and Swiss National Bank.

It shows heightened financial stability concerns among policymakers and questions the Fed’s ability to continue hiking rates. The central bank has lifted the borrowing cost by 450 basis points since March 2022, roiling asset markets, including cryptocurrencies, last year.

More importantly, the Fed’s backstopping of the global dollar liquidity reduces the risk of a worldwide dash-for-cash – investors selling everything, including bitcoin and other cryptocurrencies, and moving to cash, predominantly the U.S. dollar. During turmoil, investors typically sell risk assets and park money in cash, preferably the dollar. That drives up the cost of acquiring U.S. dollars, leading to stress in the financial system.

In other words, the increased frequency of swap lines has cleared the way for an unabated rise in risk assets, including bitcoin. The leading cryptocurrency by market value is largely seen as a hedge against the banking system and hit a nine-month high above $28,000 late Sunday, taking the cumulative month-to-date gains to nearly 25%, CoinDesk data show.

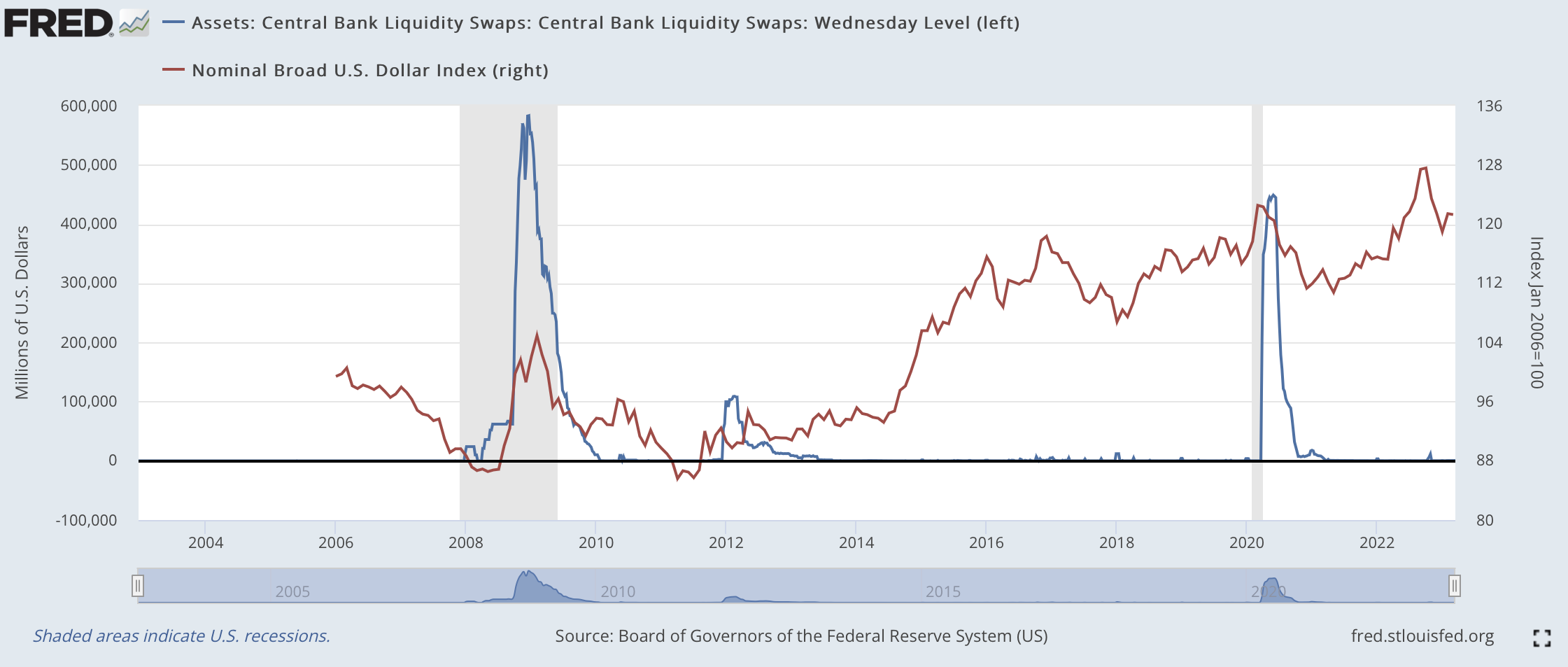

The dollar peaked after the Fed opened swap lines in March 2020. (Fred.stlouis.org) (Fred.stlouis.org)

The dollar swap lines have been bearish for the dollar in the past. Bitcoin and risk assets, in general, tend to move in the opposite direction of the greenback.

The last global dash for cash observed during the coronavirus-led crash of March 2020 saw the dollar index surge above 100 and bitcoin nosedive by over 50%.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)