Ether has become deflationary – again – as the market attempts to rebound in 2023.

Data from ultrasound.money shows ether’s net issuance, or the annualized inflation rate, has dropped to -0.07%, meaning the volume of ether being burnt is outpacing the amount that is being minted.

Marcus Sotiriou, market analyst at digital asset broker GlobalBlock, attributed the recent surge in ether burnt to a spike in the non-fungible token (NFT) sales driven by positive sentiment of the broader crypto market.

More than 14,700 ethers (ETH), worth around $24 million, have been burnt over the past seven days, according to ultrasound.money. Some 3,400 of these ETH were burned during NFT trades. NTF marketplace OpenSea is the top seven-day and 30-day gas-guzzler among platforms, ultrasound.money found.

According to data from cryptoslam, NFT sales volume jumped over 5% to $242 million over the past week and 80% of sales volume, or around $195 million, is based on the Ethereum network.

“More NFT sales on Ethereum means more transactions are occurring, resulting in more ETH being burnt,” Sotiriou told CoinDesk.

Market participants widely expected that last fall’s Ethereum Merge, which shifted the platform’s protocol from a proof-of-work (PoW) to more energy-efficient proof-of-stake (PoS) protocol, would turn ether deflationary.

Ether’s inflation rate also depends on a separate mechanism known as the Ethereum Improvement Proposal (EIP)-1559, where fees paid for transactions on the network are “burned,” or eliminated from circulation. The EIP-1559 is tied to the amount of ether burned with network usage: The more transactions on the blockchain, the more ETH is burnt.

ETH became deflationary when the amount of ether being burned rose amid market volatility triggered by crypto exchange FTX’s implosion in November. But ETH subsequently turned inflationary because of slow network usage as the crypto market remained in the doldrums.

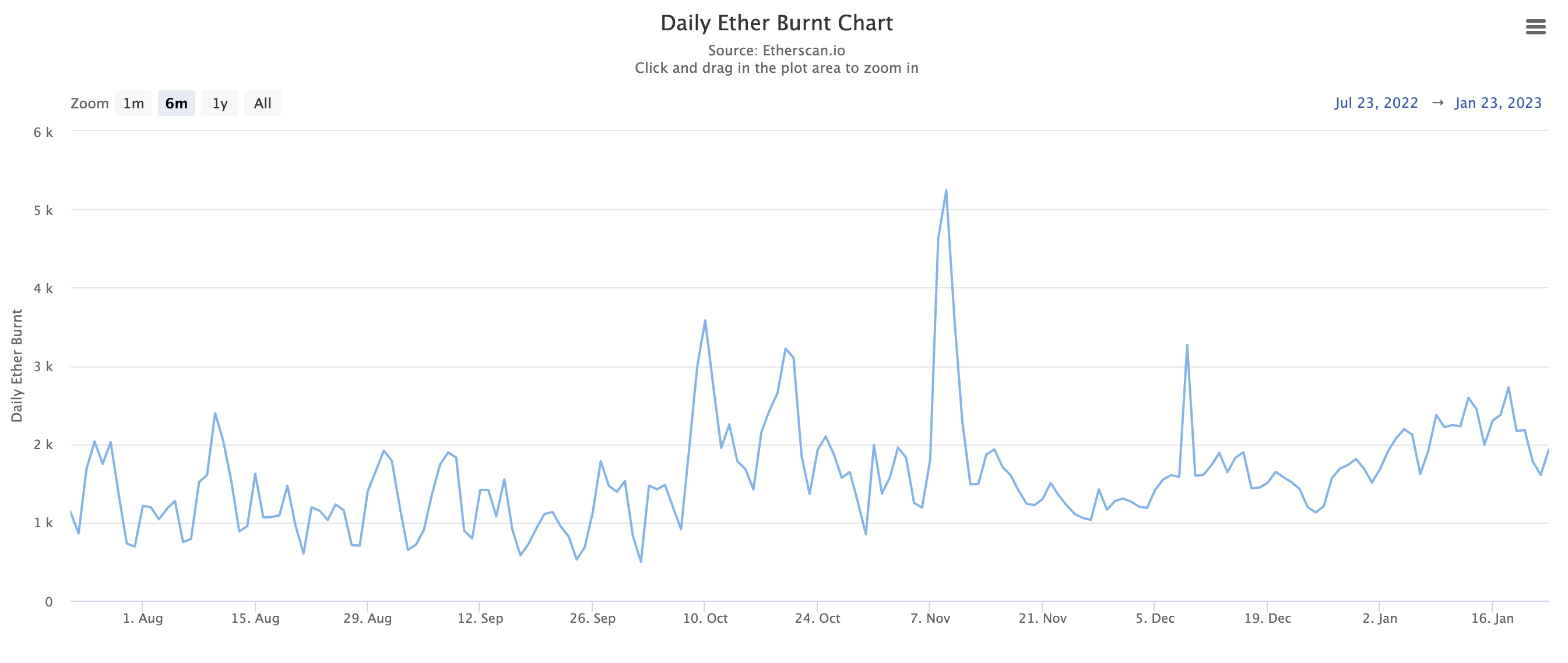

But as the market rebounded, usage of the Ethereum platform spiked and ETH turned deflationary again. Daily burn soared from levels almost exclusively between 1,000 and 2,000 ETH over the past six months to a high of over 2,700 ETH on Jan. 18, according to data from Etherscan.

Daily Ether Burnt Chart shows a slightly increasing amount of ether burnt in mid-January. (Etherscan)

As of press time, ETH was trading at $1,625 Monday, up roughly 4% in the past seven days.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.