Crypto traders endured some $307 million of liquidations in the past 24 hours, data from Coinglass shows, as crypto markets tanked Thursday on news about crypto-friendly bank Silvergate Capital (SI) winding down operations.

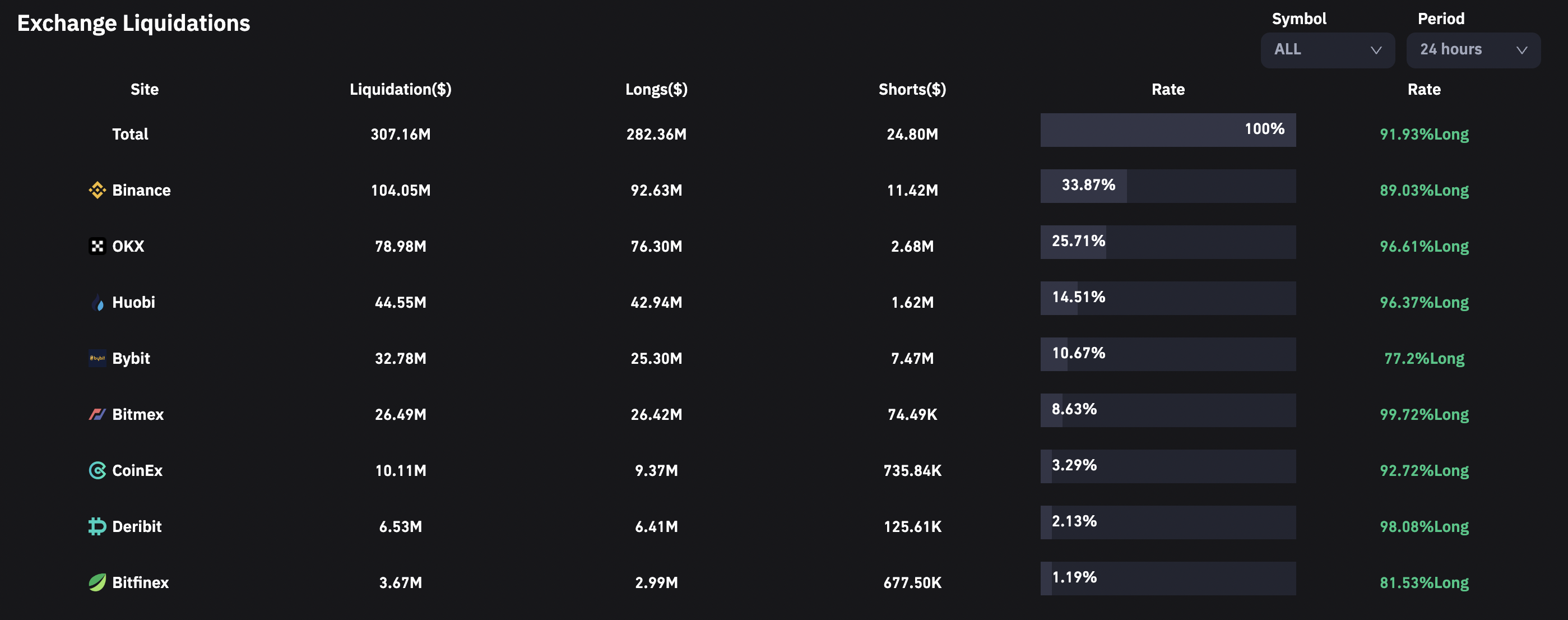

Traders on Binance, the world’s largest crypto exchange by trading volume, saw $104 million of losses, the most among exchanges, followed by $79 million of losses on OKX and $45 million on Huobi, per Coinglass.

Bitcoin (BTC) traders suffered the most losses, some $112 million, while ether (ETH) liquidations surpassed $73 million.

Of the liquidated trading positions in the past 24 hours, some $282 million were longs, betting on higher prices. This is larger than the highest daily long liquidation of this year, recording $254 million on Feb. 8, according to Coinglass.

Binance and OKX saw the most liquidations, as the recent nosedive in crypto prices caught traders off-guard. (Coinglass)

Soaring long liquidations suggest that cryptocurrency prices’ sudden nosedive caught investors off-guard. BTC, the largest cryptocurrency by market capitalization, has plummeted more than 6% in the past 24 hours, and earlier in the day, reached its lowest level in seven weeks at around $20,050. Popular altcoins dogecoin (DOGE) and tron (TRX) have led the price decline.

Crypto markets enjoyed one their strongest starts year in their 14-year history, recovering some losses from the collapse of crypto exchange FTX. BTC rallied above $25,000 in February at one point after starting the year at about $16,600.

The recent decline has come as concerns mounted about the stability of Silvergate Bank, a key banking partner for digital asset companies. After suffering huge losses and dwindling deposits, the bank announced Wednesday evening that it will “voluntarily liquidate” its assets and shut down operations.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)