-

U.S.

crypto

exchange

Coinbase

has

filed

an

action

against

the

Securities

and

Exchange

Commission,

accusing

the

agency

of

behaving

arbitrarily

and

capriciously

in

its

refusal

to

tailor

rules

to

clarify

oversight

of

the

industry. -

This

case

is

a

response

to

the

SEC’s

denial

of

the

company’s

formal

petition

for

rulemaking,

again

putting

an

important

question

for

the

future

of

crypto

regulation

before

the

courts.

Coinbase

Inc.

(COIN)

has

accused

the

U.S.

Securities

and

Exchange

Commission

of

ignoring

the

law

when

it

rebuffed

the

company’s

formal

petition

for

crypto

rules,

according

to

a

filing

Monday

in

the

U.S.

Court

of

Appeals

for

the

Third

Circuit.

Lawyers

for

Coinbase

are

arguing

that

the

securities

regulator

has

acted

arbitrarily

and

capriciously

when

it

claims

authority

over

crypto

assets

while

also

declining

to

write

new

regulations

on

how

those

assets

should

be

treated.

Instead,

the

agency

steered

its

oversight

of

digital

assets

through

its

enforcement

actions,

the

company

argued

in

the

opening

brief

of

its

lawsuit.

When

the

SEC

rejected

the

Coinbase

petition

in

December,

it

didn’t

offer

much

of

an

explanation

for

why

it

won’t

write

crypto-specific

regulations,

the

exchange’s

lawyers

are

also

arguing.

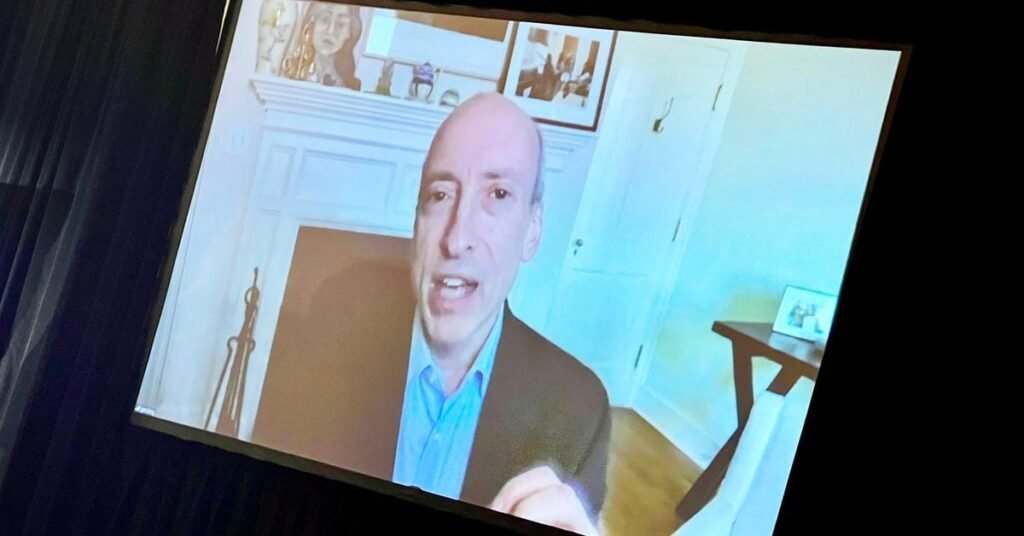

SEC

Chair

Gary

Gensler,

who

made

a

statement

when

his

agency

rejected

the

Coinbase

petition,

argued

that

the

regulator

has

been

working

on

crypto

rules

–

even

if

they’re

not

the

rules

the

industry

wants

–

and

that

“it

is

important

to

maintain

commission

discretion

in

setting

its

own

rulemaking

priorities.”

Coinbase’s

chief

legal

officer,

Paul

Grewal,

posted

Monday

on

X

that

the

SEC

owes

the

public

an

explanation

and

a

chance

to

weigh

in

on

how

it’s

using

its

powers,

saying,

“if

you

go

back

and

read

the

SEC’s

perfunctory

denial,

you’ll

be

hard

pressed

to

find

an

actual

reason

for

its

inaction.”

The

company’s

lawsuit

is

aimed

toward

forcing

that

answer.

“The

SEC

demands

that

the

industry

comply

with

inapplicable,

inapt

and

still-evolving

securities-law

requirements

or

else

join

the

many

companies

now

facing

enforcement

actions

–

including

Coinbase,”

the

company

wrote

in

its

brief.

“Yet

the

SEC

refuses

to

conduct

the

rulemaking

needed

to

set

stable

standards,

to

show

how

it

believes

compliance

with

those

irrelevant

requirements

is

even

possible

and

to

provide

a

path

to

do

so.”

While

this

week’s

latest

legal

challenge

contends

the

regulator

has

failed

to

properly

regulate

crypto,

it’s

not

directly

tied

to

Coinbase’s

epic

court

fight

with

the

SEC

that

could

eventually

help

steer

the

course

of

the

treatment

of

crypto

exchanges

under

U.S.

securities

law.

In

that

case,

the

SEC

has

accused

Coinbase

of

illegally

running

an

unregistered

exchange

that

lists

unregistered

crypto

securities.

One

thing

the

disputes

have

in

common

is

the

SEC’s

unwillingness

to

formally

define

what

makes

a

crypto

security

outside

of

the

explanations

the

agency

provides

in

its

enforcement

actions.

That

question

isn’t

answered

in

any

of

the

crypto

rulemaking

efforts

the

SEC

offers

as

proof

that

it’s

already

forming

crypto

policy.

The

agency

has

been

working

on

a

few

major

rules

that

could

–

if

they

survive

potential

court

challenges

–

have

dramatic

effects

on

how

the

industry

does

business.

Those

rules

include

proposals

to

overhaul

the

SEC’s

definition

of

exchanges

to

rope

in

crypto

platforms

and

to

require

that

investment

advisors

use

so-called

qualified

custodians

to

park

their

customers’

crypto,

and

a

rule

that

it

recently

finalized

to

expand

its

definition

of

dealers

in

a

way

that

folded

in

decentralized

finance

(DeFi)

operations.

Coinbase

is

requesting

the

federal

circuit

court

throw

out

the

SEC’s

earlier

denial

of

its

petition

and

order

the

SEC

to

get

started

on

new

crypto

rulemaking,

or

at

least

to

fully

explain

its

position.

A

spokesperson

for

the

SEC

declined

to

comment

on

the

new

suit.

The

SEC

has

spent

a

considerable

time

in

court

on

crypto

matters,

and

its

record

of

judgements

is

–

so

far

–

a

mixed

bag.

It

lost

badly

in

disputes

with

Ripple

and

Grayscale

(leading

to

the

approval

of

spot

bitcoin

exchange-traded

funds),

but

it’s

prevailed

in

others,

including

a

recent

ruling

in

an

insider-trading

case

tied

to

a

former

Coinbase

employee.

In

that

case,

a

judge

in

the

U.S.

District

Court

for

the

Western

District

of

Washington

decided

the

crypto

assets

in

that

matter

were

unregistered

securities.

Even

as

the

industry

follows

each

court

outcome

with

keen

interest,

the

cases

–

such

as

Ripple’s

–

are

likely

to

continue

to

move

through

appeals,

and

earlier

outcomes

could

be

reversed

as

the

disputes

rise

toward

potential

consideration

by

the

U.S.

Supreme

Court.

UPDATE

(March

11,

2024,

21:02

UTC):

Adds

quote

from

Coinbase

filing.

UPDATE

(March

11,

2024,

21:09

UTC):

Adds

comment

from

Coinbase

Chief

Legal

Officer

Paul

Grewal.

UPDATE

(March

11,

2024,

21:58

UTC):

Adds

Coinbase’s

request

to

the

court.

UPDATE

(March

11,

2024,

22:43

UTC):

Adds

SEC

response.