Bitcoin (BTC) held above $23,000 on Friday as traders awaited next week’s Federal Open Market Committee decision on interest rates and any hints policymakers may drop about when their hiking campaign might end.

The largest cryptocurrency by market capitalization recently changed hands at around $23,100, up 0.1% for the day.

It’s been a roaring start to 2023 for bitcoin, which has surged in price by more than 40% since New Year’s Eve. BTC surpassed $23,000 for the first time since mid-2022 about a week ago and has managed to stay in that territory.

“Bitcoin should still consolidate leading up to the Federal Open Market Committee (FOMC) decision, with risks to the downside if the Fed sticks to its hawkish mantra,” Edward Moya, senior market analyst at foreign exchange Oanda, wrote in a Friday note about the Federal Reserve’s rate-setting unit.

Traditional markets were also slightly up, with the S&P 500 Index up about 0.3%.

The crypto rally came after the latest Personal Consumption Expenditures (PCE) report showed a slowdown in inflation at the end of last year – a goal the Fed has been aiming for with rate hikes. The CME FedWatch tool currently shows that traders see roughly a 99% chance the FOMC will raise rates by 25 basis points (0.25 percentage point) at its February meeting.

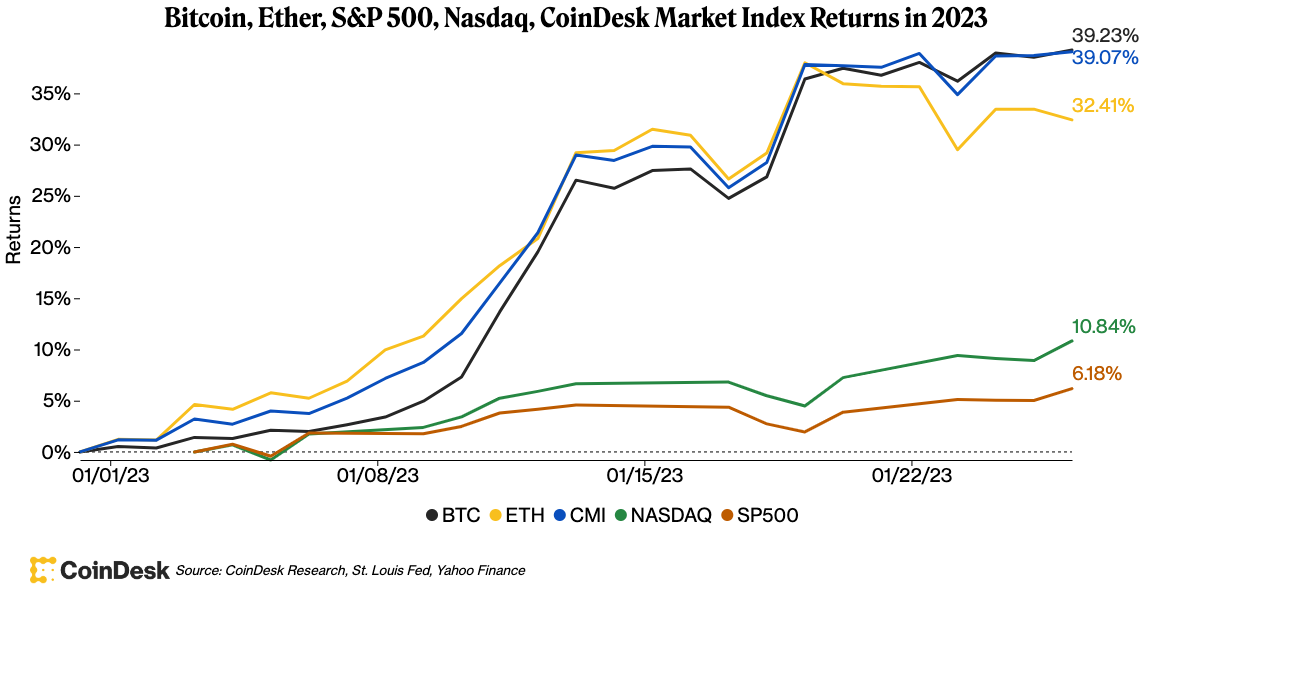

With the recent broader market rally, top crypto assets like bitcoin and ether (ETH) have topped equities this year: ETH is up about 32%, while the CoinDesk Market Index is up 39%. In comparison, the S&P 500 and the Nasdaq Composite index were up 6% and 10%, respectively.

Bitcoin and ether have outperformed equities this year so far. (CoinDesk)

Joel Kruger, markets strategist at crypto exchange LMAX Digital, said that from a technical standpoint the price of BTC is currently overbought, as seen by the daily relative strength index (RSI) that measures the magnitude of recent price changes.

According to data from TradingView, the RSI indicator showed a level of 81.9 on Friday. (Readings above 70 suggest an asset is overbought.)

TradingView chart shows the relative strength index has been increasing since mid-January. (TradingView)

Kruger told CoinDesk that BTC’s next important resistance to watch comes in at around $25,200 based on its August peak. He wouldn’t rule out “the possibility of seeing BTC go down $10,000 in the first half of the year” or seeing its rally “above $50,000 in the second half of the year.”

“There’s a lot of room to go either way,” he said. “I’m just wondering if there’s one more shoe to drop before we finally see that next big push.”

Data sourced from Coinglass shows the funding rates for BTC currently sit at around 0.01% as of Friday, a signal that market sentiment leans bullish among traders, but are “still far from the 0.06% levels recorded in February or November of 2021 when traders were paying 80% more annualized to long bitcoin,” according to Lucas Outumuro, head of research at crypto data and analysis firm IntoTheBlock, in a Friday newsletter.

Outumuro wrote that “the current levels in derivatives suggest the market is optimistic, but at the same time not yet overheated, which could create grounds for the ongoing rally to persist.”

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.