Major digital assets took a plunge in the early hours of the business day Hong Kong time.

Bitcoin and Ether both dropped over 5% as major crypto firms continue to distance themselves from Silvergate. During the U.S. trading day, Silvergate’s stock dropped over 50% as crypto clients continue to flee the bank. Most of the top 10 other cryptocurrencies by market cap saw similar declines.

The rapid sell-off took a toll on Coinbase, which began experiencing connectivity issues at 10:20 AM Hong Kong time.

“Institutions are a bit jumpy as Silvergate seems to be having issues,: said Nick Ruck of ContentFi, a web3 venture studio, in a note to CoinDesk.

Ruck also pointed to the release of some of Mt. Gox’s bitcoin, which would increase its circulating supply, as another source of volatility.

Other major crypto exchanges, including Binance, Bitfinex, Kucoin, OKX and Kraken did not report similar issues.

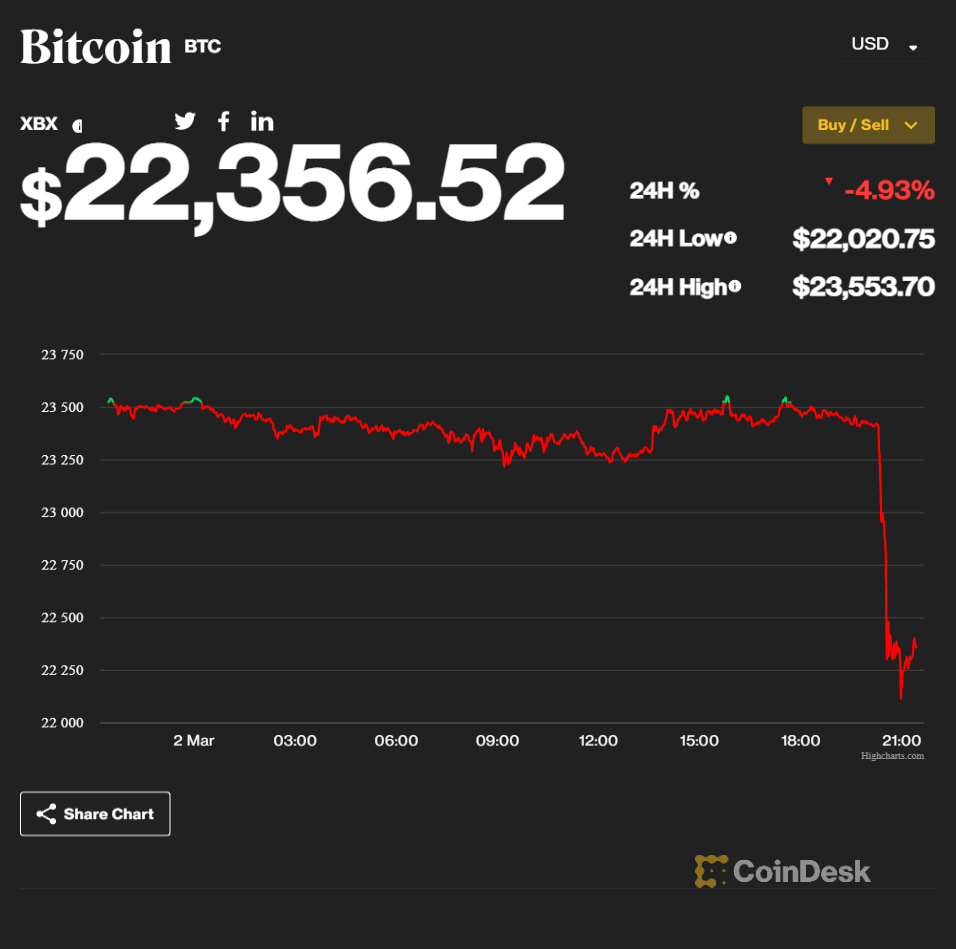

Bitcoin’s price fell to an intraday low of $22,020 as Asia trading hours began, after remaining roughly steady at $23,500 for most of the past day. It appeared to rebound slightly, climbing to just under $22,400 after its plunge.

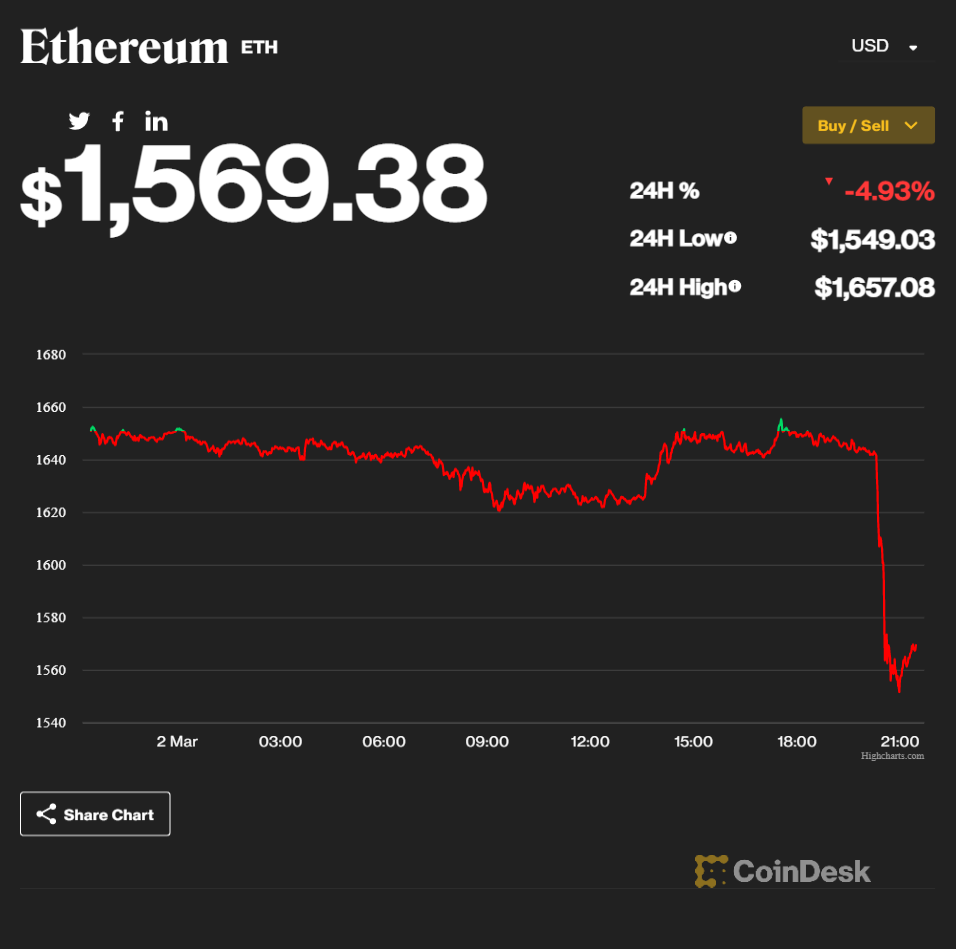

Ether saw a similar pattern, falling to $1,550 after spending the past day hovering around $1,650 with limited change.

Bitcoin’s market cap declined by over $20 billion to $431.9 billion according to CoinMarketCap. Crypto’s overall market cap is at $1.07 trillion.

Open interest in bitcoin is down by 8.8% in the last four hours according to Coinglass. Open interest on Ether is down by 5%.

UPDATE (March 3, 2023, 02:45 UTC): Adds additional detail.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/DBZcP3UNJ61mcJVidu80gi3BhSw=/arc-photo-coindesk/arc2-prod/public/2SPHXH5UCJAE7FOOGBZ4LCGRFI.png)

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)