Although

MakerDAO’s

dai

(DAI)

might

be

the

most

successful

decentralized

stablecoin,

last

year

founder

Rune

Christensen

worried

the

project

was

teetering

on

the

edge

of

collapse.

So

he

set

about

coming

up

with

a

rescue

plan.

Christensen’s

proposal,

now

known

as

Endgame,

is

a

massive

expansion

of

the

Maker

project,

which

would

see

the

release

of

new

stablecoins,

new

ways

to

generate

revenue

and

potentially

limitless

new

business

prospects

through

the

creation

of

“subDAOs.”

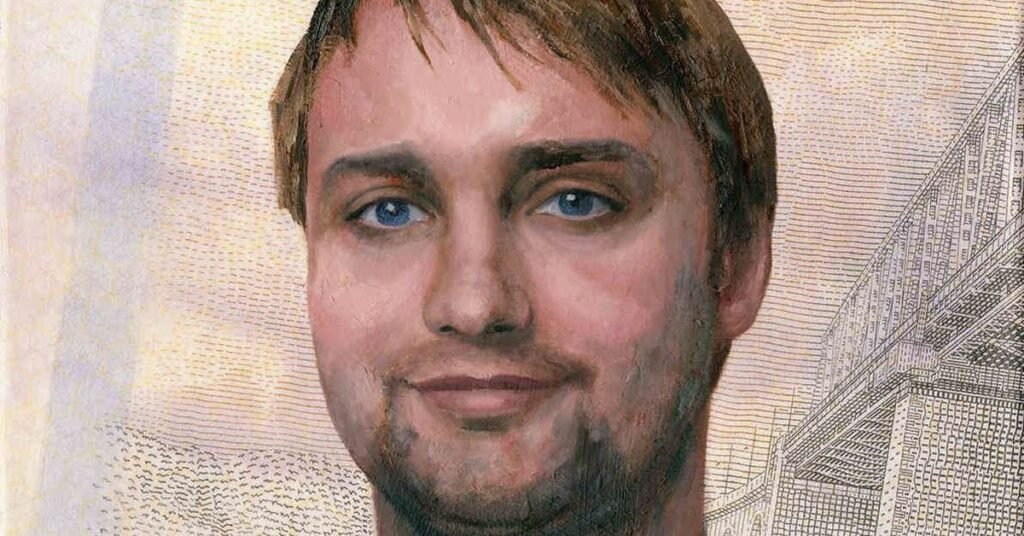

CoinDesk

sat

down

with

Christensen

for

a

wide-ranging

interview

to

get

a

better

sense

of

what’s

coming

down

the

pike

as

Endgame

begins

to

roll

out

as

early

as

this

summer.

We

connected

on

May

17,

the

day

Maker

announced

the

coming

release

of

two

fully

decentralized

stablecoins,

NewStable

and

PureDAI,

which

will

eventually

replace

DAI,

which

has

a

market

cap

of

over

$5

billion.

So

it’s

a

big

news

day

for

you

guys.

You

could

say

that.

Would

you

say

the

idea

of

launching

a

more

decentralized

stablecoin

is

a

tacit

acknowledgment

that

dai

(DAI)

should

have

always

pursued

decentralization

first

and

foremost?

I

mean,

there’s

mainly

two

approaches

to

decentralization

in

DeFi.

One

uses

decentralization

as

a

tool

and

the

other

is

using

it

as

sort

of

the

guiding

–

I

wouldn’t

call

it

an

ideology,

but

this

underlying

measure

or

the

end

goal

itself.

What

this

announcement

touches

on

is

how

these

two

things

interact

when

using

decentralization

as

a

tool.

If

you’re

thinking

about

someone

building

a

product

that’s

useful

for

end

users,

then

making

it

decentralized

should

be

done

for

a

specific

reason

like

resilience

and

the

ability

to

offer

features.

Whereas

when

decentralization

is

your

guiding

ideology,

then

the

product

itself

is

pure

decentralization.

It’s

two

very

different

user

bases

and

demographics,

right?

Our

second

user

base

is

the

OG

Bitcoin

and

Ethereum

types

that

value

purity.

But

the

vast

majority

of

people,

especially

the

more

mature

crypto

gets,

are

more

interested

in

useful

products.

We

especially

see

this

with

stablecoins.

With

the

stablecoin

trilemma

it’s

very

hard

to

scale.

If

you

have

a

$1

peg,

you

have

to

use

real

assets,

which

will

always

limit

decentralization.

What

are

MakerDAO’s

core

values?

When

Maker

started

it

was

during

a

time

when

all

these

early

experiments

and

random

ideas,

which

were

mostly

pointless

[were

floating

around].

We

wanted

to

try

to

build

something

useful

to

people

with

this

technology.

We’re

really

lucky

that

we

had

that

perspective

because

it

brought

us

to

build

a

stablecoin,

which,

at

the

time,

was

kind

of

a

boring

idea

that

nobody

wanted

to

do.

All

that

other

stuff

was

cool,

but

you

couldn’t

use

it

unless

there’s

something

stable.

It

turns

out

that

a

stablecoin

is

actually

the

most

powerful

business

model;

it’s

basically

been

the

product

that

has

taken

off

and

come

out

of

blockchain

technology

that

has

actually

impacted

people.

Big

time,

right?

Ultimately,

the

reason

why

we’re

in

the

game

now,

the

reason

why

we

are

basically

making

a

lot

of

major

changes

is

we’re

basically

trying

to

rethink

from

first

principles.

How

to

really

build

something

useful

that’s

going

to

benefit

people

that

also

benefits

from

all

the

things

you

can

do

with

decentralization.

Do

you

feel

like

you

have

a

good

sense

of

where

Endgame

will

end

up?

So

the

real

basic

concept

of

Endgame

is

really

growth

and

resilience

–

that’s

the

overall

goal.

It

has

to

be

something

that

can

grow

exponentially,

and

as

it

grows

it

gets

more

and

more

resilient.

The

core

idea

of

Endgame

is

to

reach

an

end

state

of

the

system,

so

it

doesn’t

have

to

change

anymore

to

the

extent

that’s

possible.

That

kind

of

taps

into

the

original

Bitcoin

values,

this

principle

that

decentralization

is

good,

resilience

is

good,

reliability

is

good.

But

to

give

people

what

they

want,

you

have

to

be

able

to

adapt

to

the

market.

So

that’s

where

subDAOs

come

into

the

picture;

you

enable

the

core

of

the

system

to

reach

this

end

state

and

become

immutable.

…

That

then

allows

for

subDAOs

to

take

care

of

all

the

complexity,

adaptation

and

innovation

that

can

attract

new

users.

That’s

basically

where

the

whole

journey

begins.

We

have

to

see

what

actually

works

in

practice

before

we

commit

to

something

and

follow

market

cues.

It’s

hard

to

predict

everything

in

advance

and

then

just

build

it

exactly

the

way

it

was

predicted.

Usually

that

would

not

result

in

something

that

is

actually

very

useful

to

people.

It’s

better

to

sort

of

figure

out

what

people

actually

want

and

then

move

in

that

direction

with

it.

What

do

you

make

of

the

trend

of

DeFi

brands,

like

Aave,

for

instance,

expanding

beyond

their

core

category?

I

mean,

it’s

the

same

sort

of

thing

that

is

pushing

us

towards

Endgame

at

Maker.

So

actually

I

think

Aave’s

attempt

at

decentralizing

social

media

is

a

bit

of

an

outlier.

I

think

the

more

classic

way

this

is

happening

is

– Frax

was

the

first

project

to

articulate

this,

when

they

were

talking

about

how

every

project

ends

up

sort

of

doing

all

the

code

bases

models,

right?

So

if

you’re

DeFi,

probably

you’ll

also

be

doing

lending,

you’ll

be

doing

stablecoin,

you’ll

be

doing

exchange.

Maker

also

is

doing

a

DEX,

lending

and

stablecoins.

The

reason

why

this

is

happening

is

because

the

real

challenge

all

of

this

is

not

really

building

the

actual

products,

it’s

having

the

governance

layer

in

a

DAO

to

maintain

it

all.

So

that’s

where

all

the

complexity

and

investment

goes:

having

the

ability

to

make

the

decisions

that

maintain

something

like

that.

If

you

already

have

that

capability

for

doing

it

with

a

stablecoin,

then

you’ve

already

paid

the

majority

of

the

cost

and

it’s

very

easy

to

add

more

features

using

the

same

governance

rails.

And

in

fact,

you

kind

of

have

to

do

that

because

it’s

so

expensive

and

difficult

to

maintain

the

governance.

With

Endgame,

we’re

taking

this

to

the

absolute

extreme,

because

we’re

building

this

extremely

advanced,

extremely

sophisticated

governance

layer

that

we

will

be

reusing

again

and

again

and

again

with

subDAOs.

That’s

the

economies

of

scale

–

experience

and

data

is

gained

from

all

the

different

subDAOs.

Do

you

ever

feel

that

MakerDAO

governance

is

over-engineered?

I

believe

the

problem

is

that

it’s

undere-ngineered.

The

problem

is

the

reason

why

you

can

simplify

governance.

I

mean,

that’s

what

we

did

originally,

right?

We

built

the

technical

layer,

we

built

the

protocol,

and

put

a

simple

voting

system

on

it

and

released

it

assuming

that

the

free

market

would

take

care

of

it

because

the

community

will

vote

in

their

own

best

interests.

But

unfortunately,

what

actually

happens

in

DAOs

is

politics.

So

the

problem

is

the

assumption

in

any

group

setting

–

in

any

political

setting,

you

could

say

–

is

that

when

somebody

makes

a

proposal

or

makes

an

adjustment

to

a

public

system

they’re

doing

that

to

benefit

the

system,

right?

That’s

the

game

theory.

…

But

the

real

game

theory

is

that

people

will

do

whatever

is

best

for

them.

Everybody

wants

to

vote

to

give

themselves

money.

If

you

just

have

enough

honest

people,

they

can

see

that

happening

and

then

shut

it

down.

The

problem

is

you

get

this

additional

layer

of

politics

where

what

happens

is

people

will

kind

of

argue

over

some

proposal

that’s

supposed

to

be

in

the

best

interest

of

the

whole

system.

They’ll

say

“it’s

so

great

and

I’m

so

selfless

proposing

this,”

but

there

will

be

an

underlying

motivation.

It’s

incredibly

difficult

to

tell

when

it

is

genuine.

Humans

are

just

like

that,

right?

They

will

be

obfuscated

and

they

will

collaborate

and

you’ll

have

groups

with

shared

interests.

The

point

of

all

this

is

it

is

very,

very

complex

–

you

can’t

“solve”

human

politics.

The

only

real

answer

to

this

is

basically

to

put

in

place

some

hierarchy,

a

leader

that

you

have

faith

in

to

decide

who’s

being

honest.

The

only

alternative

to

that

is

to

try

to

build

out

a

transparent

framework

that

contains

all

of

that

knowledge,

like

all

the

knowledge

that

a

CEO

typically

has

in

a

company.

You

want

to

have

as

much

public

data

and

knowledge

as

possible

so

when

you

pay

for

a

particular

engineering

task,

you

know

if

you

were

overpaying

and

how

to

quality-check

it.

You

can’t

leave

all

those

decisions

up

to

voters

because

they’ll

vote

for,

like,

their

own

supplier

that

gets

paid

10x

market

price.

But

you

can’t

figure

out

if

that’s

happening

unless

you

actually

have

the

data

and

these

processes

built.

In

a

sense,

it’s

an

extremely

challenging

engineering

effort

where

you

have

to

build

all

these

processes

to

be

detail-oriented,

because

every

single

black

box

you

leave

anywhere

in

the

governance

system

is

like

leaving

a

bug

in

a

smart

contract

that

a

hacker

can

come

and

hack.

That’s

the

direction

we’re

slowly

going

in

at

Maker

by

building

Atlas,

which

is

sort

of

a

big

governance

layer.

Do

you

think

you

would

make

a

good

politician?

No.

I

mean,

like,

I

definitely

have

had

to

develop

those

types

of

skills

to

basically

deal

with

the

problem

of

doing

stuff

with

DAOs.

But

I’m

definitely

not

naturally

–

I’m,

well,

I’m

not

exactly

a

technical

person

in

the

sense

that

I’m

not

doing

any

of

the

code

in

Maker,

but

I’m

definitely

more

technically

minded.

What

do

they

call

it?

A

shape

rotator

rather

than

a

wordcel.

That’s

funny.

You

can

feel

free

to

decline

to

answer,

but

do

you

have

any

sense

of

why

those

VCs

collaborated

to

vote

against

Endgame?

Well,

it

was

not

all

the

VCs.

I

think

there

were

three

prominent

ones.

I

think

at

that

point,

like

everyone

else,

they

were

very

disappointed

with

what

had

happened

with

the

project

because

it

had

sort

of

taken

off

–

it

had

grown

a

lot

and

then

suddenly

it

lost

all

its

revenue

and

had

crazy

expenses.

And

then

I

think

from

their

perspective,

they

probably

just

viewed

Endgame

as

some

kind

of

desperate

sort

of

fever

dream,

right?

Like,

it’s

already

bad

and

now

it’s

gonna

fail

fully

and

their

tokens

are

going

to

become

worthless.

And

then

they

actually

sold

all

their

MKR

when

they

failed

to

vote

against

it.

Unfortunately

for

them,

they

sold

right

at

the

bottom.

Then

what

happened

was

you

had

this

new

generation

of

hedge

funds

and

VCs

coming

in

and

buying

up

all

their

MKR.

These

were

institutions

that

were

explicitly

very,

very

excited

about

Endgame,

they

bought

because

they

actually

thought

this

was

a

cool

idea.

And

I

think

that’s

what

you

want

–

the

MKR

did

its

job

because

you

actually

want

voters

to

be

aligned.

When

exactly

did

you

start

thinking

that

you

had

to

do

Endgame?

It

really

all

came

from

the

problem

of

the

politics

I

just

talked

about,

right?

The

budgets.

I

saw

what

was

happening,

and

then

I

started

extrapolating

and

I

realized

it

would

get

so

much

worse

–

like,

the

project

would

die.

That’s

where

the

idea

of

subDAOs

came

from,

a

way

of

starting

from

fresh

so

you

can

set

the

right

direction,

the

right

momentum,

with

the

right

knowledge.

You

can’t

just

put

people

in

a

DAO,

and

then

have

the

free

market

steer

things.

You

have

to

really

give

them

the

data,

give

them

the

frameworks,

give

them

the

tools

to

move

in

the

right

direction

where

there’s

interaction.

And

even

when

you

do

that,

it

will

still

fail

sometimes.

That’s

the

other

thing,

it’s

a

fresh

start

for

communities

that

are

specialized

in

particular

areas

so

they

can

become

more

streamlined.

Spark

will

be

a

subDAO

focused

on

DeFi

innovation.

And

then

there

are

other

subDAOs

that

can

be

about

gaming

or

financial

inclusion

by

serving

as

a

way

to

get

yield

for

potential

users,

for

instance,

which

is

a

huge

crypto

demographic

that

hasn’t

really

seen

an

advanced

crypto

product.

You

get

to

make

these

bets

on

new

communities

that

have

a

particular

direction

led

by

a

group

of

people

that

believe

in

that

direction.

The

other

major

thing

is

they’re

allowed

to

fail.

It’s

designed

so

that

if

a

subDAO

fails,

it

doesn’t

damage

the

whole

thing,

which

is

kind

of

a

problem

with

Maker.

See

also:

Rune

Radio

The

last

part

is

solving

how

to

make

growth

really

take

off,

because

DAI

was

really

only

adopted

by

crypto

natives.

The

branding

was

sort

of

quite

random.

So

with

Endgame,

we’re

rebranding

to

try

to

fix

that.

The

ace

up

our

sleeve

that

we

have

is

decentralization.

SubDAOs

will

function

as

an

adoption

funnel

through

tokens

that

offer

yield

to

holders

of

the

new

stablecoin

with

new

and

better

branding.

It’s

exactly

the

same

asset

–

the

only

question

is

how

are

you

getting

the

yield

for

the

DAI

savings

rate?

It’s

a

bit

like

DeFi

Summer,

where

yield

farming

was

essentially

risk

free.

So

it’s

a

way

to

sort

of

get

the

growth,

excitement,

experience,

and

maintain

its

resilience

as

it

grows

so

people

are

not

losing

the

money.

So

you

can

really

kind

of

just

push

it

and

adopt

it.

How

do

you

deal

with

the

stress

of

leading

one

of

the

most

important

DeFi

projects?

It’s

really

hard

for

me

to

explain

how

I

dealt

with

it

in

the

past

because

it

was

really

crazy.

The

early

days

of

crypto

were

so

insane

–

unreal

situations,

crazy

drama,

crazy

personalities,

a

lot

of

toxicity.

The

main

way

I

dealt

with

it

is

that

the

more

I

tried

to

improve

what

we

were

trying

to

build

–

making

something

useful

for

people

–

the

better

things

got.

Gradually,

things

have

just

been

getting

better

and

better.

Even

dealing

with

Endgame

–

this

massive

change

–

is

nothing

compared

to

the

early

days

of

Maker.

Are

you

still

thinking

about

making

an

MMORPG?

I

actually

have

a

gaming

company

that’s

building

an

MMORPG

that

I

founded

around

the

time

the

Maker

Foundation

wound

down.

Being

in

Europe,

are

you

at

all

concerned

about

the

Tornado

Cash

verdict?

I

ask

because

the

judge

essentially

said

founders

could

be

criminally

liable

for

code

they

release

that

they

suspect

could

be

misused.

I

think

the

problem

with

privacy

technology

is

that

it

attracts

a

lot

of

bad

guys

and

illicit

use.

There’s

naturally

a

large

illicit

user

base.

But

there

are

also

way

more

legitimate

users.

It’s

like

a

road,

bad

people

use

the

roads,

but

the

vast

majority

are

regular

people.

It’s

a

big

challenge,

because

we

need

privacy

technology,

right?

We

have

a

right

to

privacy,

but

these

tools

often

end

up

as

honeypots

in

a

sense.

But

obviously

Maker

has

always

focused

on

having

good

relationships

with

regulators

because

we

want

adoption

by

regular

people.

And

we’ve

achieved

that.

A

lot

of

people

use

and

benefit

from

the

system,

which

makes

it

dramatically

different

from

something

like

Tornado

Cash.

Today’s

announcement

of

a

completely

decentralized

stablecoin

detached

from

Maker

wouldn’t

have

KYC

though,

by

definition.

It

seems

like

prosecutors,

when

they

can’t

shut

something

down,

try

to

put

a

person

behind

the

code.

Yeah,

but

again

it

comes

back

to

whether

it

has

some

kind

of

legitimate

use.

The

point

is

if

you’re

making

it

easy

to

do

bad

things

with

this

technology.

There

is

no

privacy

on

the

blockchain,

right?

Everything

is

totally

transparent.

You

have

Chainalysis

monitoring

everything.

Mixers

thwart

that.

The

best

example

of

all

is

the

banking

system,

because

this

is

happening

all

the

time

at

a

much

greater

scale.

You

can

be

fully

anonymous

in

crypto

if

you’re

just

smart

enough.

But

in

the

banking

system,

it’s

actually

pretty

easy

because

you

just

need

to

bribe

a

few

corrupt

bankers

or

something

like

that.

It’s

pretty

straightforward.

So

the

thing

that

would

get

risky

for

us,

even

though

I

think,

again,

that

there

is

a

moral

obligation

to

figure

out

how

to

do

this

in

a

way

that

doesn’t

just

disproportionately

benefit

criminals,

is

to

build

a

privacy

solution

into

a

decentralized

currency.

It’s

very

hard

to

do

that

safely

and

without

becoming

a

target.

We’re

definitely

not

going

to

build

you

know,

native

privacy

into

pure

DAI

or

anything

like

that.

Do

you

want

to

do

a

quick

round

of

Overrated/Underrated?

Underrated.

Life

extension

research?

Overrated.

Ai

risk

research?

Overrated.

AI

itself?

Underrated.

Overrated.

Blockchain

gaming?

Overrated.

Could

you

say

why?

I

think

it

has

a

ton

of

potential,

but

I’m

really

disappointed

in

basically

almost

everything.

The

amount

of

attempts

and

quality

of

the

attempts

is

just

very

disappointing.

There’s

something

wrong

with

the

culture

–

like,

everyone’s

just

doing

it

for

the

money.

And

it’s

pushing

away

real

builders

who

are

never

going

to

touch

the

blockchain

gaming

industry.

If

you

had

the

right

people

trying

to

do

it,

you

could

build

some

really

cool

things

and

we’ll

get

there.

But

the

signal-to-noise

ratio

is

crazy.

How

much

MKR

do

you

own

or

control?

You

can

log

onto

Etherscan

and

find

my

wallet.

It’s

pretty

easy.

Is

there

anything

that

you

want

to

talk

about?

I

mean,

the

only

thing

that’s

important

to

me

right

now

is

just

how

impactful

launch

season

will

be.

There

are

many

new

things

coming

and

it

can

be

quite

difficult

to

explain

–

there’ll

be

a

new

brand,

new

token,

new

app.

There’ll

be

these

different

options

if

you’re

a

DAI

holder

that

you

can

choose.

It’s

really,

really

powerful

stuff.

We

spent

two

years

just

distilling

all

the

things

that

have

been

learned

basically

since

the

beginning

of

DeFi.

And

then

we

are

sort

of

launching

all

the

key

aspects

of

those,

but

trying

to

make

it

simple

and

easy

to

use.

The

killer

feature

is

yield

farming,

which

I

think

will

be

relevant

for

a

lot

of

people.

But

it’s

hard

to

explain

in

advance

that

you

will

be

able

to

save

money

with

low

risk,

like

you’re

used

to

with

stablecoins,

but

now

you

can

get

these

very

interesting

and

valuable

tokens

as

you

do

it.

Yield

farming

is

sometimes

described

as

a

marketing

expense.

Would

you

agree

with

that?

Yeah,

I

think

that

was

kind

of

the

old

version

of

yield

farming

that

others

have

done.

But

nowadays

we

have

designed

a

system

where

the

yield

side

actually

makes

the

protocol

sustainable.

What

was

risky

before,

even

if

you

were

doing

it

with

stablecoins,

is

that

you

were

doing

it

in

untested,

brand-new

smart

contracts.

So

there’s

gonna

be

a

lot

of

technical

risk.

In

our

case,

there

is

no

technical

risk

–

or

very

low

technical

risk

–

because

it’s

just

as

safe

as

all

the

other

components

of

the

Maker

system.

There’s

financial

risk,

but

with

the

new

subDAOs

and

tokens

there

will

be

a

lot

of

incentives.

In

10

years

where

do

you

think

Tether

will

be?

I

think

it

would

probably

be

even

bigger

than

it

is

today.

They

are

reaching

escape

velocity

and

they’re

not

even

paying

any

yield.

They’re

just

growing

and

growing

and

growing

because

it’s

so

useful.

The

number

one

thing

that

makes

a

stablecoin

useful

is

the

network

effect,

right?

People

use

tether

because

everyone

else

uses

it,

so

they

already

have

that

flywheel.

We

definitely

hope

to

get

to

that

point

as

well.

But

fundamentally

the

bed

we’re

making

with

Endgame

is

we

can’t

guarantee

we

get

to

that

point

at

least

within

some

timeframe

we

can

control.

So

we

are

really

focusing

on

the

yield

aspect

so

we

have

a

growth

driver

that

is

independent

from

requiring

this

huge

network

effect.

But

then

we

may

be

able

to

use

this

yield

growth

driver

to

build

up

a

huge

network

of

users

and

start

to

get

this

sort

of

compounding

effect.

It

could

be

very

successful

and

profitable,

even

if

it

was

never

used

as

a

currency

at

all.

Maybe

it’s

just

like

a

savings

account

to

tether

or

something

like

that.

This

was

great,

good

luck.

I

appreciate

the

candid

responses.