Tokenized gold assets surpassed $1 billion in combined market capitalization on Tuesday, according to data by crypto price tracker CoinGecko, as gold’s price neared its all-time high.

Tokenized gold is a type of stablecoin that pegs its price to gold, while the tokens on the blockchain represent ownership of physical gold managed by the issuer. It offers investors a way to get exposure to the precious metal without the management fees of an exchange-traded fund (ETF) or the burden of storing gold bullions.

The two largest gold stablecoins – by far – are pax gold (PAXG), issued by the New York-based fintech firm Paxos Trust Company, and tether gold (XAUT), issued by Tether, the same company behind the $80 billion-pegged stablecoin USDT. At the time of publication time, the market cap of PAXG and XAUT is $518 million and $499 million, respectively, per CoinGecko data.

The price of gold, a traditional safe-haven asset, has risen since March amid investor concerns about flailing banks and a possible government bailout, which would lead to expanding fiat money supply and currency devaluation. The metal was trading at $2,021 per ounce on Tuesday, just some 3% off its all-time high recorded in August 2020.

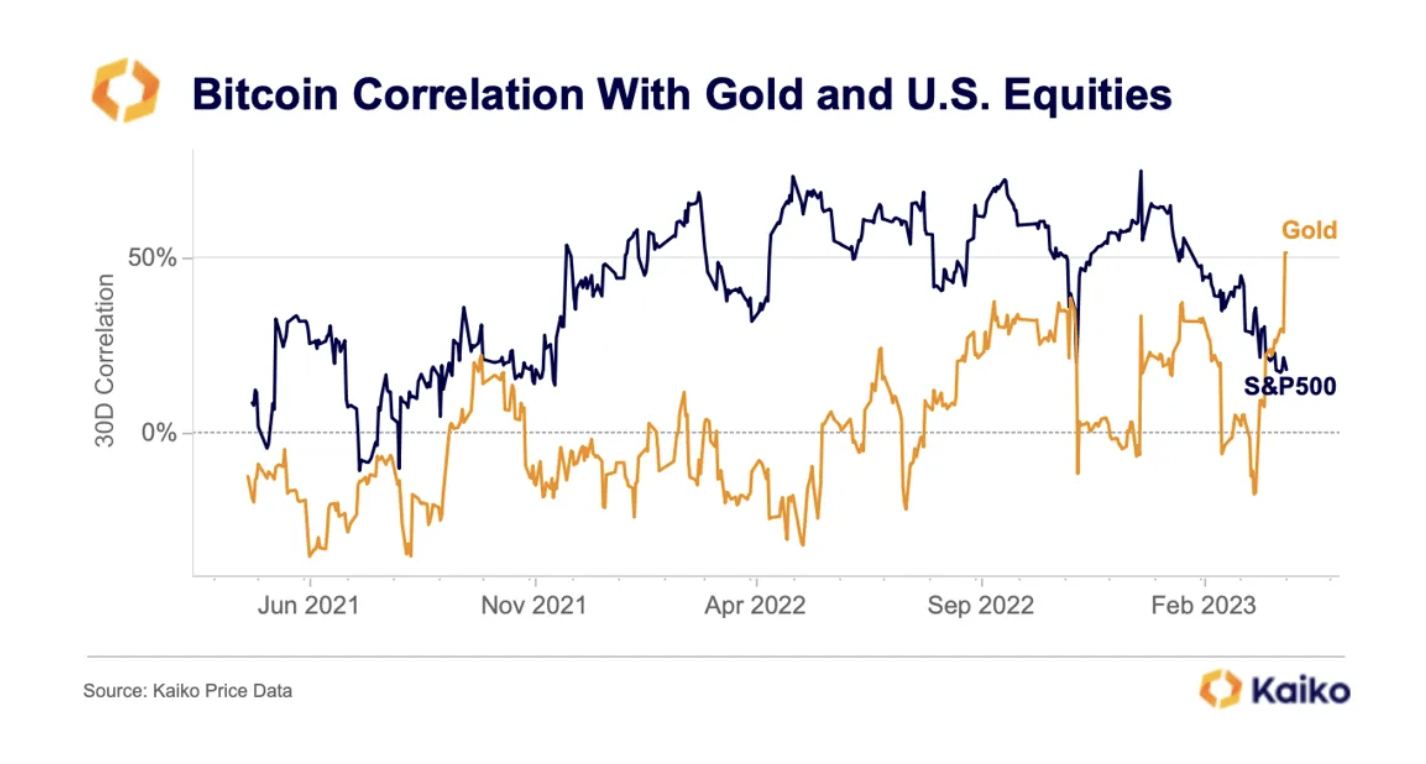

Bitcoin (BTC), which is often called digital gold due its program-coded supply cap, has rallied to as high as $29,000 from $20,000 in tandem with gold’s surge. BTC’s correlation with gold hit a multi-year high last week, surpassing equities, digital asset market research firm Kaiko reported Monday.

BTC correlation with gold, equities (Kaiko)

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)