Circle Internet Financial’s USDC stablecoin saw some $1 billion in net redemptions since Friday morning when Silicon Valley Bank (SVB), one of Circle’s banking partners, was shut down by regulators, blockchain transactions from crypto intelligence platform Nansen show.

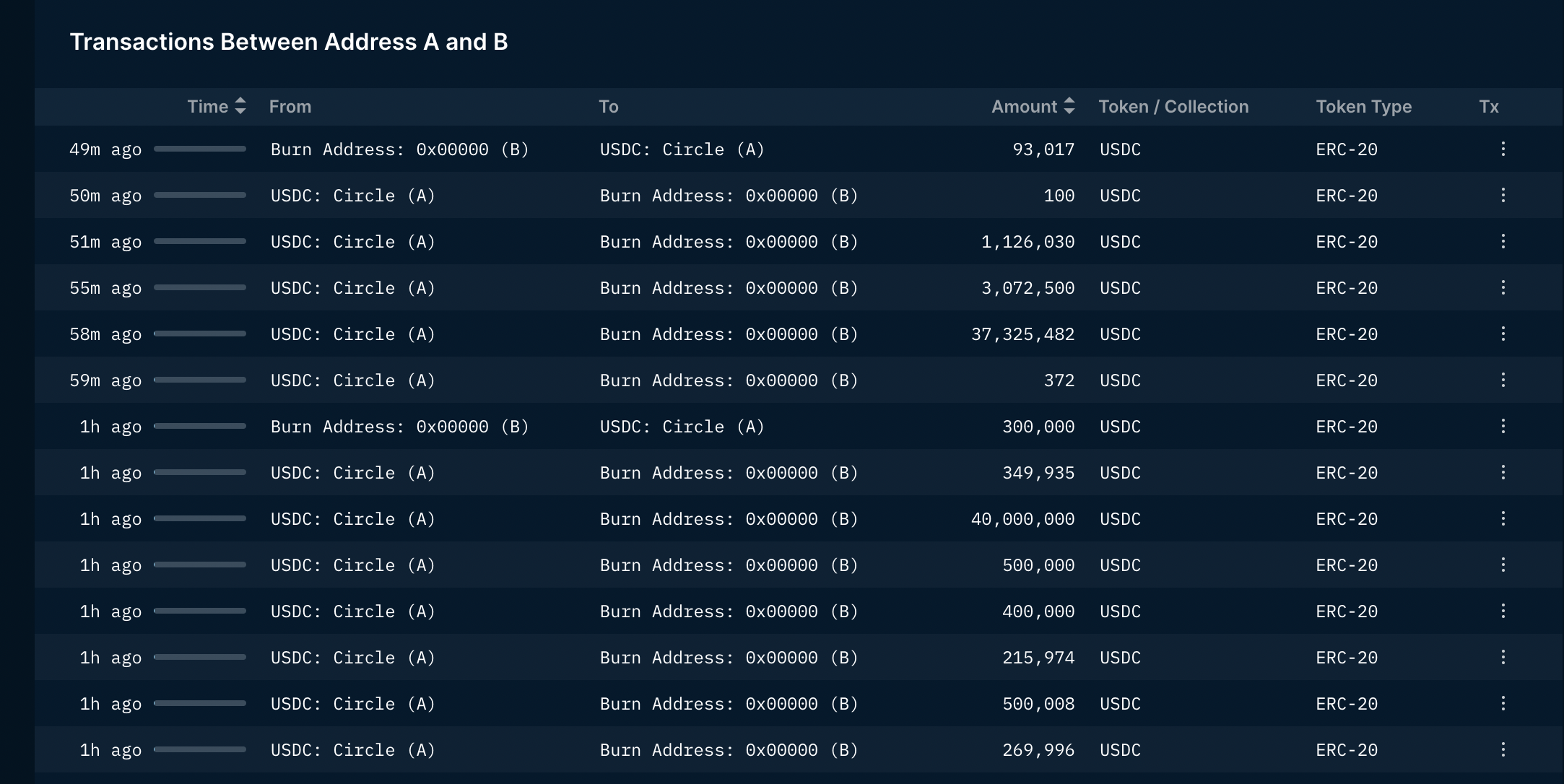

According to Nansen, Circle burned some $1.6 billion of USDC on Friday, taking out the tokens from circulation as investors redeemed dollars. Circle also minted new coins, adding to the circulation, but much less than it destroyed.

Subsequently, USDC’s market capitalization fell to $42.4 billion from $43.5 billion on Friday, according to data from CoinMarketCap. USDC also depegged from $1, a sign of worry about the state of its reserves.

Investors rushed to redeem USDC tokens for dollars, blockchain data shows. (Nansen)

USDC is the second-largest stablecoin, trailing only Tether’s USDT, and a backbone of the crypto ecosystem. The token’s value is backed by U.S. government bonds and cash-like assets, including a total $11.1 billion of cash deposits at various regulated banks, according to Circle’s website.

Investors grew concerned with the stablecoin’s stability after SVB, one of the banks where Circle held a part of USDC’s backing assets, suffered a bank run. Regulators shut down the bank’s operations on Friday morning.

A Circle spokesperson told CoinDesk Friday afternoon that SVB was one of six banks who managed “the approximately 25% portion of USDC reserves held in cash.”

“While we await clarity on how the FDIC receivership of Silicon Valley Bank will impact its depositors, Circle and USDC continue to operate normally,” the spokesperson added.

Sage D. Young contributed reporting.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)