Bitcoin edged higher to top $22,500 early Monday before retreating slightly below that mark in the afternoon.

The largest cryptocurrency by market value was recently trading above $22,400 and squarely in the narrow range it’s occupied since Thursday when traders liquidated some $78 million in long positions amid worries about Silvergate Capital. Bitcoin (BTC) had been trading at around $23,500 for much of the previous week winding into February.

“It seems the more Wall Street positions itself for a major sell-off with risky assets, markets refuse to break,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in an email.

In a newsletter Monday, Jeff Dorman, chief investment officer at digital asset investment firm Arca, wrote that the crypto market’s stability in recent days suggested the drop in price late Thursday “may have been just a single seller (or small group of sellers) rather than a market-wide panic.”

ETH, the second-largest cryptocurrency, was recently changing hands at $1,569, up 0.4% from Sunday, same time. The CoinDesk Market Index, which measures overall crypto market performance, was flat for the day.

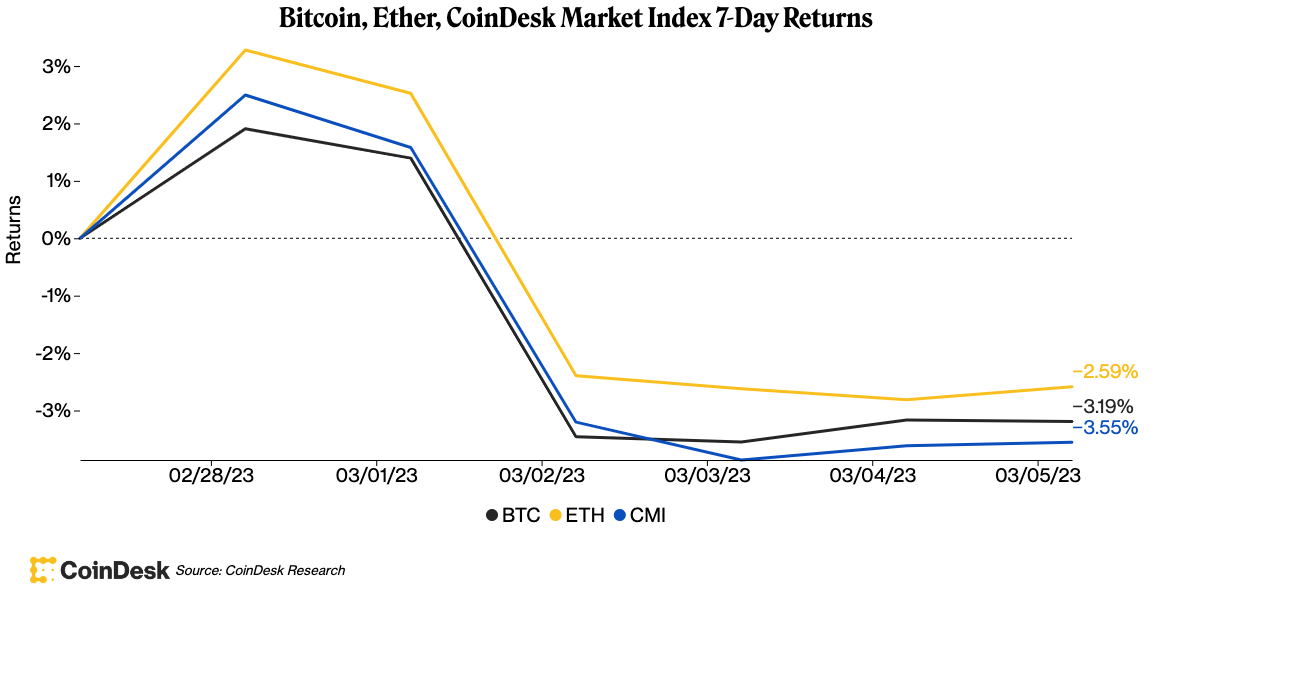

BTC and ETH have tumbled about 3.1% and 2.5%, respectively, over the past seven days. A report from crypto data firm Kaiko highlighted that the funding rates of these two assets turned negative last week, suggesting bearish market sentiment.

(CoinDesk)

California-based Silvergate said in a filing last week that the impact of recent events – notably the FTX exchange collapse and subsequent regulatory actions – raised questions about the bank’s ability to “continue as a going concern.” In the ensuing days, industry fallout has widened with multiple businesses including Coinbase and Paxos cutting ties with the bank. Shares of Silvergate (SI) closed down 6.2% Monday.

“Silvergate made the mistake of merging traditional banking with a centralized cryptocurrency exchange model,” Sheraz Ahmed, managing partner at blockchain consultancy Storm Partners, told CoinDesk. Ahmed sees an increasing likelihood of the crypto market contracting as the industry endures fresh liquidity crises.

“The first crypto bull market to attract institutional involvement ended not too long ago, and many still needed to prepare for a steep market drop,” he said. “Unfortunately, those that didn’t are paying the price.”

On Friday, Silvergate Capital terminated its Silvergate Exchange Network (SEN), the instant payment service that allowed real-time crypto-to-fiat transfers between investors and exchanges. But in an interview with CoinDesk TV’s “First Mover” Monday, Hany Rashwan, CEO of crypto investment product firm 21.co, said the closure of the SEN platform didn’t necessarily have “a material impact” on BTC’s price.

Eric Chen, CEO and co-founder of the decentralized finance(DeFi) protocol Injective, noted in an email to CoinDesk that it’s important to monitor whether exchanges that previously used SEN service can “smoothly integrate new payment partners” to “ensure uninterrupted settlement speed and volume.”

“It’s crucial to remember that properly capitalized and managed exchanges should be able to weather this storm with minimal disruption to their operations,” he added.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Read more about

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)